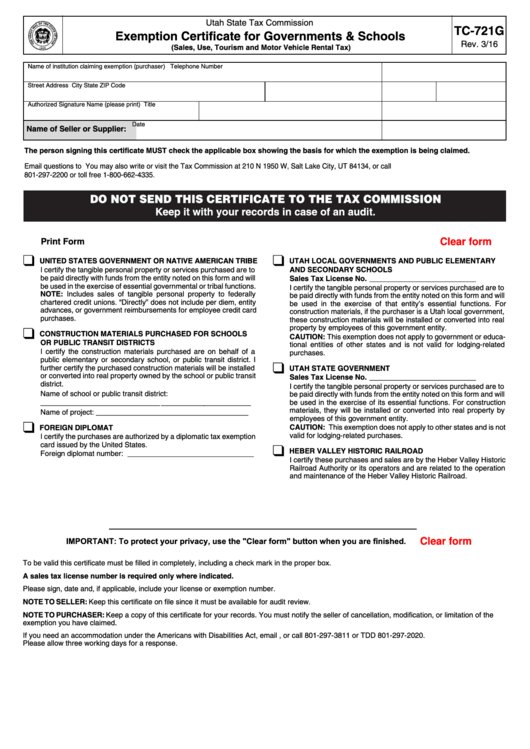

Utah State Tax Commission

TC-721G

Exemption Certificate for Governments & Schools

Rev. 3/16

(Sales, Use, Tourism and Motor Vehicle Rental Tax)

Name of institution claiming exemption (purchaser)

Telephone Number

Street Address

City

State

ZIP Code

Authorized Signature

Name (please print)

Title

Date

Name of Seller or Supplier:

The person signing this certificate MUST check the applicable box showing the basis for which the exemption is being claimed.

Email questions to taxmaster@utah.gov. You may also write or visit the Tax Commission at 210 N 1950 W, Salt Lake City, UT 84134, or call

801-297-2200 or toll free 1-800-662-4335.

DO NOT SEND THIS CERTIFICATE TO THE TAX COMMISSION

Keep it with your records in case of an audit.

Print Form

Clear form

❑

❑

UNITED STATES GOVERNMENT OR NATIVE AMERICAN TRIBE

UTAH LOCAL GOVERNMENTS AND PUBLIC ELEMENTARY

I certify the tangible personal property or services purchased are to

AND SECONDARY SCHOOLS

be paid directly with funds from the entity noted on this form and will

Sales Tax License No. _ __ ___ __ __ __ _ _ _ _

be used in the exercise of essential governmental or tribal functions.

I certify the tangible personal property or services purchased are to

NOTE: Includes sales of tangible personal property to federally

be paid directly with funds from the entity noted on this form and will

chartered credit unions. “Directly” does not include per diem, entity

be used in the exercise of that entity’s essential functions. For

advances, or government reimbursements for employee credit card

construction materials, if the purchaser is a Utah local government,

purchases.

these construction materials will be installed or converted into real

❑

property by employees of this government entity.

CONSTRUCTION MATERIALS PURCHASED FOR SCHOOLS

CAUTION: This exemption does not apply to government or educa-

OR PUBLIC TRANSIT DISTRICTS

tional entities of other states and is not valid for lodging-related

I certify the construction materials purchased are on behalf of a

purchases.

public elementary or secondary school, or public transit district. I

❑

further certify the purchased construction materials will be installed

UTAH STATE GOVERNMENT

or converted into real property owned by the school or public transit

Sales Tax License No. _ __ ___ __ __ __ _ _ _ _

district.

I certify the tangible personal property or services purchased are to

Name of school or public transit district:

be paid directly with funds from the entity noted on this form and will

___ _ _ __ __ __ _____ _ _________ _ _ __ _ _

be used in the exercise of its essential functions. For construction

materials, they will be installed or converted into real property by

Name of project: __ ____ _ _ __ _ _ _ _ __ _ _ _ _ __ _

employees of this government entity.

❑

FOREIGN DIPLOMAT

CAUTION: This exemption does not apply to other states and is not

valid for lodging-related purchases.

I certify the purchases are authorized by a diplomatic tax exemption

❑

card issued by the United States.

HEBER VALLEY HISTORIC RAILROAD

Foreign diplomat number: __ __ _ _ _ _ __ _ _ _ _ _ __ _ _

I certify these purchases and sales are by the Heber Valley Historic

Railroad Authority or its operators and are related to the operation

and maintenance of the Heber Valley Historic Railroad.

IMPORTANT: To protect your privacy, use the "Clear form" button when you are finished.

Clear form

To be valid this certificate must be filled in completely, including a check mark in the proper box.

A sales tax license number is required only where indicated.

Please sign, date and, if applicable, include your license or exemption number.

NOTE TO SELLER: Keep this certificate on file since it must be available for audit review.

NOTE TO PURCHASER: Keep a copy of this certificate for your records. You must notify the seller of cancellation, modification, or limitation of the

exemption you have claimed.

If you need an accommodation under the Americans with Disabilities Act, email taxada@utah.gov, or call 801-297-3811 or TDD 801-297-2020.

Please allow three working days for a response.

DO NOT SEND THIS CERTIFICATE TO THE TAX COMMISSION

1

1