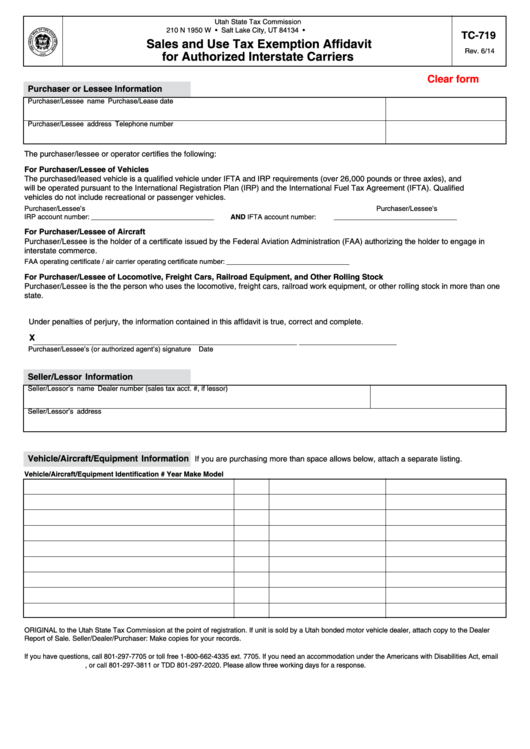

Utah State Tax Commission

210 N 1950 W • Salt Lake City, UT 84134 • tax.utah.gov

TC-719

Sales and Use Tax Exemption Affidavit

Rev. 6/14

for Authorized Interstate Carriers

Clear form

Purchaser or Lessee Information

Purchaser/Lessee name

Purchase/Lease date

Purchaser/Lessee address

Telephone number

The purchaser/lessee or operator certifies the following:

For Purchaser/Lessee of Vehicles

The purchased/leased vehicle is a qualified vehicle under IFTA and IRP requirements (over 26,000 pounds or three axles), and

will be operated pursuant to the International Registration Plan (IRP) and the International Fuel Tax Agreement (IFTA). Qualified

vehicles do not include recreational or passenger vehicles.

Purchaser/Lessee’s

Purchaser/Lessee’s

IRP account number: __ _ _ _ _ _ _ _ _ _ __ _ _ _ __ _

AND

IFTA account number: _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ __

For Purchaser/Lessee of Aircraft

Purchaser/Lessee is the holder of a certificate issued by the Federal Aviation Administration (FAA) authorizing the holder to engage in

interstate commerce.

FAA operating certificate / air carrier operating certificate number: _ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _

For Purchaser/Lessee of Locomotive, Freight Cars, Railroad Equipment, and Other Rolling Stock

Purchaser/Lessee is the the person who uses the locomotive, freight cars, railroad work equipment, or other rolling stock in more than one

state.

Under penalties of perjury, the information contained in this affidavit is true, correct and complete.

X

____ _ _ _ __ _ _ _ _ _ __ _ _ _ __ _ _ _ __ _ _ _ __ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Purchaser/Lessee’s (or authorized agent’s) signature

Date

Seller/Lessor Information

Seller/Lessor’s name

Dealer number (sales tax acct. #, if lessor)

Seller/Lessor’s address

Vehicle/Aircraft/Equipment Information

If you are purchasing more than space allows below, attach a separate listing.

Vehicle/Aircraft/Equipment Identification #

Year

Make

Model

ORIGINAL to the Utah State Tax Commission at the point of registration. If unit is sold by a Utah bonded motor vehicle dealer, attach copy to the Dealer

Report of Sale. Seller/Dealer/Purchaser: Make copies for your records.

If you have questions, call 801-297-7705 or toll free 1-800-662-4335 ext. 7705. If you need an accommodation under the Americans with Disabilities Act, email

taxada@utah.gov

, or call 801-297-3811 or TDD 801-297-2020. Please allow three working days for a response.

1

1