Application For West Virginia Manufacturing Investment Tax Credit For Investments Placed In Service Form

ADVERTISEMENT

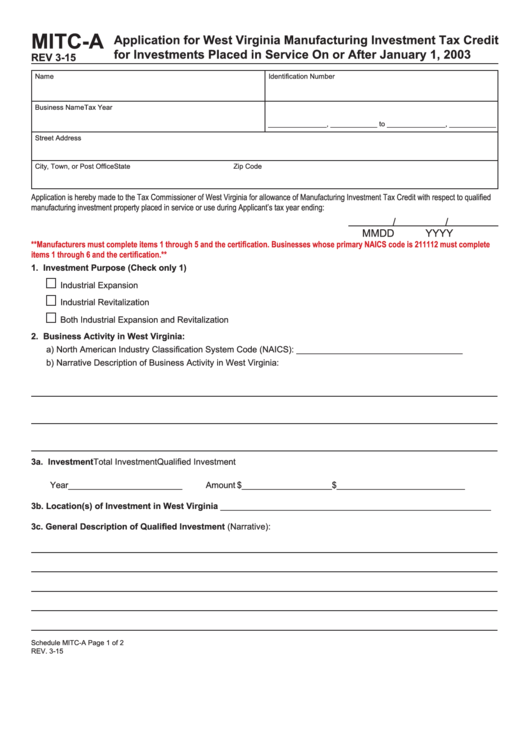

MITC-A

Application for West Virginia Manufacturing Investment Tax Credit

for Investments Placed in Service On or After January 1, 2003

REV 3-15

Name

Identification Number

Business Name

Tax Year

_______________, ____________ to _______________, ____________

Street Address

City, Town, or Post Office

State

Zip Code

Application is hereby made to the Tax Commissioner of West Virginia for allowance of Manufacturing Investment Tax Credit with respect to qualified

manufacturing investment property placed in service or use during Applicant’s tax year ending:

/

/

MM

DD

YYYY

**Manufacturers must complete items 1 through 5 and the certification. Businesses whose primary NAICS code is 211112 must complete

items 1 through 6 and the certification.**

1. Investment Purpose (Check only 1)

Industrial Expansion

Industrial Revitalization

Both Industrial Expansion and Revitalization

2. Business Activity in West Virginia:

a) North American Industry Classification System Code (NAICS): ___________________________________

b) Narrative Description of Business Activity in West Virginia:

3a. Investment

Total Investment

Qualified Investment

Year________________________

Amount $___________________

$___________________________

3b. Location(s) of Investment in West Virginia _________________________________________________________

3c. General Description of Qualified Investment (Narrative):

Schedule MITC-A Page 1 of 2

REV. 3-15

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4