Form Il-501 - Payment Coupon And Instructions - 2016

ADVERTISEMENT

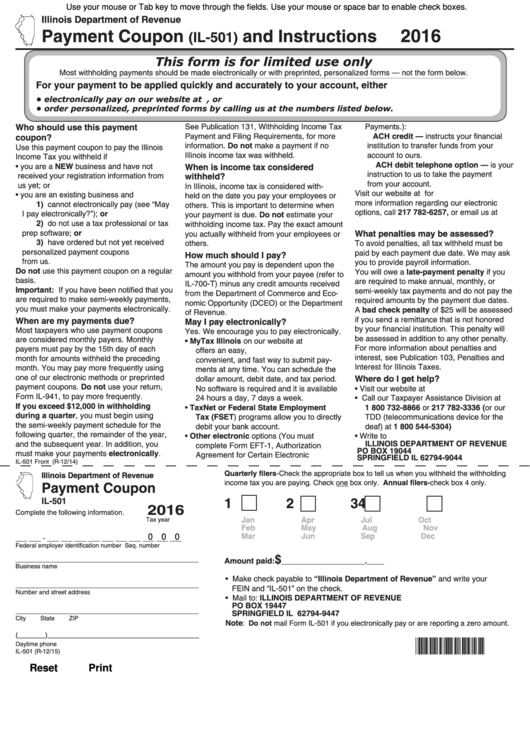

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

2016

Payment Coupon

and Instructions

(IL-501)

This form is for limited use only

Most withholding payments should be made electronically or with preprinted, personalized forms — not the form below.

For your payment to be applied quickly and accurately to your account, either

•

electronically pay on our website at tax.illinois.gov, or

•

order personalized, preprinted forms by calling us at the numbers listed below.

Who should use this payment

See Publication 131, Withholding Income Tax

Payments.):

Payment and Filing Requirements, for more

ACH credit — instructs your financial

coupon?

information. Do not make a payment if no

institution to transfer funds from your

Use this payment coupon to pay the Illinois

Illinois income tax was withheld.

account to ours.

Income Tax you withheld if

ACH debit telephone option — is your

• you are a NEW business and have not

When is income tax considered

instruction to us to take the payment

received your registration information from

withheld?

from your account.

us yet; or

In Illinois, income tax is considered with-

Visit our website at tax.illinois.gov for

• you are an existing business and

held on the date you pay your employees or

more information regarding our electronic

1) cannot electronically pay (see “May

others. This is important to determine when

options, call 217 782-6257, or email us at

I pay electronically?”); or

your payment is due. Do not estimate your

rev.taxpay@illinois.gov.

2) do not use a tax professional or tax

withholding income tax. Pay the exact amount

prep software; or

What penalties may be assessed?

you actually withheld from your employees or

3) have ordered but not yet received

others.

To avoid penalties, all tax withheld must be

personalized payment coupons

paid by each payment due date. We may ask

How much should I pay?

from us.

you to provide payroll information.

The amount you pay is dependent upon the

Do not use this payment coupon on a regular

You will owe a late-payment penalty if you

amount you withhold from your payee (refer to

basis.

are required to make annual, monthly, or

IL-700-T) minus any credit amounts received

Important: If you have been notified that you

semi-weekly tax payments and do not pay the

from the Department of Commerce and Eco-

are required to make semi-weekly payments,

required amounts by the payment due dates.

nomic Opportunity (DCEO) or the Department

you must make your payments electronically.

A bad check penalty of $25 will be assessed

of Revenue.

if you send a remittance that is not honored

When are my payments due?

May I pay electronically?

by your financial institution. This penalty will

Most taxpayers who use payment coupons

Yes. We encourage you to pay electronically.

be assessed in addition to any other penalty.

are considered monthly payers. Monthly

• MyTax Illinois on our website at

For more information about penalties and

payers must pay by the 15th day of each

tax.illinois.gov offers an easy,

interest, see Publication 103, Penalties and

month for amounts withheld the preceding

convenient, and fast way to submit pay-

Interest for Illinois Taxes.

month. You may pay more frequently using

ments at any time. You can schedule the

one of our electronic methods or preprinted

Where do I get help?

dollar amount, debit date, and tax period.

payment coupons. Do not use your return,

No software is required and it is available

• Visit our website at tax.illinois.gov

Form IL-941, to pay more frequently.

24 hours a day, 7 days a week.

• Call our Taxpayer Assistance Division at

If you exceed $12,000 in withholding

• TaxNet or Federal State Employment

1 800 732-8866 or 217 782-3336 (or our

during a quarter, you must begin using

Tax (FSET) programs allow you to directly

TDD (telecommunications device for the

the semi-weekly payment schedule for the

debit your bank account.

deaf) at 1 800 544-5304)

following quarter, the remainder of the year,

• Other electronic options (You must

• Write to

ILLINOIS DEPARTMENT OF REVENUE

and the subsequent year. In addition, you

complete Form EFT-1, Authorization

PO BOX 19044

must make your payments electronically.

Agreement for Certain Electronic

SPRINGFIELD IL 62794-9044

IL-501 Front (R-12/14)

Quarterly filers-Check the appropriate box to tell us when you withheld the withholding

Illinois Department of Revenue

income tax you are paying. Check one box only. Annual filers-check box 4 only.

Payment Coupon

1

2

3

4

IL-501

2016

Complete the following information.

Jan

Apr

Jul

Oct

Tax year

Feb

May

Aug

Nov

Mar

Jun

Sep

Dec

0 0 0

___ ___ - ___ ___ ___ ___ ___ ___ ___ ___ ___ ___

Federal employer identification number

Seq. number

$

_______________________________________________

Amount paid:

___________________.____

Business name

• Make check payable to “Illinois Department of Revenue” and write your

_______________________________________________

FEIN and “IL-501” on the check.

Number and street address

• Mail to:

ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19447

_______________________________________________

SPRINGFIELD IL 62794-9447

City

State

ZIP

Note:

Do not mail Form IL-501 if you electronically pay or are reporting a zero amount.

(_______)_______________________________________

*IL-501*

Daytime phone

IL-501 (R-12/15)

Reset

Print

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1