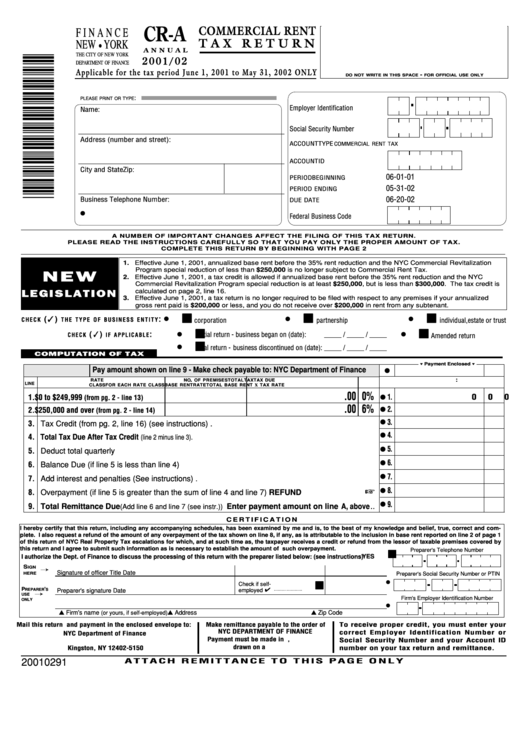

Form Cr-A - Commercial Rent Tax Return - 2001/02

ADVERTISEMENT

CR-A

COMMERCIAL RENT

F I N A N C E

T A X R E T U R N

NEW

YORK

G

A N N U A L

THE CITY OF NEW YORK

2 0 0 1 / 0 2

DEPARTMENT OF FINANCE

Applicable for the tax period June 1, 2001 to May 31, 2002 ONLY

-

DO NOT WRITE IN THIS SPACE

FOR OFFICIAL USE ONLY

:

PLEASE PRINT OR TYPE

Employer Identification Number...

Name:

Social Security Number............

__________________________________________________________________

Address (number and street):

....................

ACCOUNT TYPE

COMMERCIAL RENT TAX

.......................

ACCOUNT ID

__________________________________________________________________

City and State

Zip:

06-01-01

................

PERIOD BEGINNING

................... 05-31-02

PERIOD ENDING

__________________________________________________________________

06-20-02

Business Telephone Number:

..............................

DUE DATE

G

.............

Federal Business Code

A NUMBER OF IMPORTANT CHANGES AFFECT THE FILING OF THIS TAX RETURN.

PLEASE READ THE INSTRUCTIONS CAREFULLY SO THAT YOU PAY ONLY THE PROPER AMOUNT OF TAX.

COMPLETE THIS RETURN BY BEGINNING WITH PAGE 2

1. Effective June 1, 2001, annualized base rent before the 35% rent reduction and the NYC Commercial Revitalization

Program special reduction of less than $250,000 is no longer subject to Commercial Rent Tax.

N E W

2. Effective June 1, 2001, a tax credit is allowed if annualized base rent before the 35% rent reduction and the NYC

Commercial Revitalization Program special reduction is at least $250,000, but is less than $300,000. The tax credit is

calculated on page 2, line 16.

L E G I S L AT I O N

3. Effective June 1, 2001, a tax return is no longer required to be filed with respect to any premises if your annualized

gross rent paid is $200,000 or less, and you do not receive over $200,000 in rent from any subtenant.

I I

I I

I I

( )

G

G

G

:

C H E C K

T H E T Y P E O F B U S I N E S S E N T I T Y

corporation

partnership

individual, estate or trust

I I

I I

( )

G

G

:

initial return - business began on (date):

_____ / _____ / _____

C H E C K

I F A P P L I C A B L E

Amended return

I I

G

final return - business discontinued on (date): _____ / _____ / _____

COMPUTATION OF TAX

M

Payment Enclosed

M

A. Payment -

Pay amount shown on line 9 - Make check payable to: NYC Department of Finance

G

.

:

RATE

NO

OF PREMISES

TOTAL

TAX

TAX DUE

LINE

CLASS

FOR EACH RATE CLASS

BASE RENT

RATE

TOTAL BASE RENT X TAX RATE

.00 0%

G

1. $0 to $249,999

1.

0

0 0

(from pg. 2 - line 13)

.00 6%

G

2.

2. $250,000 and over

(from pg. 2 - line 14)

G

3.

3. Tax Credit (from pg. 2, line 16) (see instructions).............................................................................

G

4.

4. Total Tax Due After Tax Credit

...................................................................................

(line 2 minus line 3).

G

5.

5. Deduct total quarterly payments ......................................................................................................

G

6.

6. Balance Due (if line 5 is less than line 4) .........................................................................................

G

7.

7. Add interest and penalties (See instructions) ...................................................................................

G

8.

8. Overpayment (if line 5 is greater than the sum of line 4 and line 7) .............................REFUND

G

9.

9. Total Remittance Due

Enter payment amount on line A, above..

(Add line 6 and line 7 (see instr.))

C E R T I F I C A T I O N

I hereby certify that this return, including any accompanying schedules, has been examined by me and is, to the best of my knowledge and belief, true, correct and com-

plete. I also request a refund of the amount of any overpayment of the tax shown on line 8, if any, as is attributable to the inclusion in base rent reported on line 2 of page 1

of this return of NYC Real Property Tax escalations for which, and at such time as, the taxpayer receives a credit or refund from the lessor of taxable premises covered by

this return and I agree to submit such information as is necessary to establish the amount of such overpayment.

I I

Preparer's Telephone Number

I authorize the Dept. of Finance to discuss the processing of this return with the preparer listed below: (see instructions) YES

S

IGN

¡

Signature of officer

Title

Date

HERE

Preparer's Social Security Number or PTIN

I I

G

Check if self-

employed ✔

P

'

REPARER

S

Preparer's signature

Date

¡

USE

Firm's Employer Identification Number

ONLY

G

L Firm's name

L Address

L Zip Code

(or yours, if self-employed)

Mail this return and payment in the enclosed envelope to:

Make remittance payable to the order of

To receive proper credit, you must enter your

NYC DEPARTMENT OF FINANCE

correct Employer Identification Number or

NYC Department of Finance

Payment must be made in U.S. dollars,

Social Security Number and your Account ID

P.O. Box 5150

drawn on a U.S. bank.

Kingston, NY 12402-5150

number on your tax return and remittance.

20010291

A T T A C H R E M I T T A N C E T O T H I S P A G E O N L Y

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2