2009 Local Earned Income/net Profits Tax And Flat Rate Occupation Tax Return - Hollidaysburg Area School District Tax Office

ADVERTISEMENT

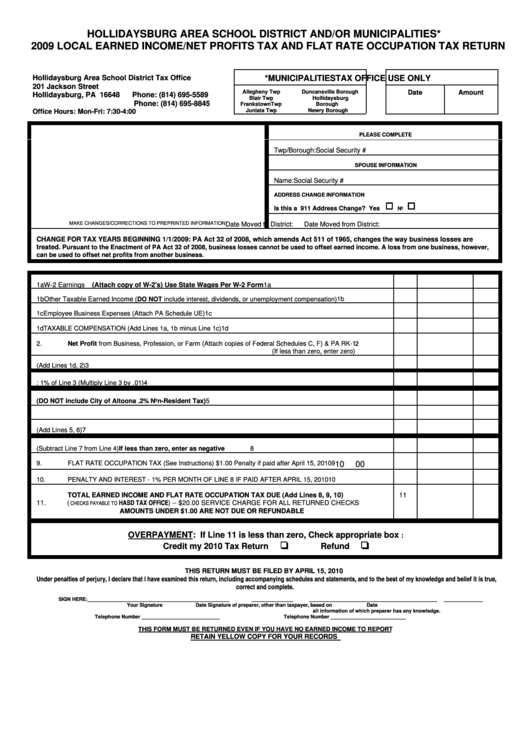

HOLLIDAYSBURG AREA SCHOOL DISTRICT AND/OR MUNICIPALITIES*

2009 LOCAL EARNED INCOME/NET PROFITS TAX AND FLAT RATE OCCUPATION TAX RETURN

Hollidaysburg Area School District Tax Office

*MUNICIPALITIES

TAX OFFICE USE ONLY

201 Jackson Street

Allegheny Twp

Duncansville Borough

Date

Amount

Hollidaysburg, PA 16648

Phone: (814) 695-5589

Blair Twp

Hollidaysburg

Phone: (814) 695-8845

FrankstownTwp

Borough

Juniata Twp

Newry Borough

Office Hours: Mon-Fri: 7:30-4:00

PLEASE COMPLETE

Twp/Borough:

Social Security #

SPOUSE INFORMATION

Name:

Social Security #

ADDRESS CHANGE INFORMATION

9

9

Is this a 911 Address Change? Yes

No

MAKE CHANGES/CORRECTIONS TO PREPRINTED INFORMATION

Date Moved to District:

Date Moved from District:

CHANGE FOR TAX YEARS BEGINNING 1/1/2009: PA Act 32 of 2008, which amends Act 511 of 1965, changes the way business losses are

treated.

Pursuant to the Enactment of PA Act 32 of 2008, business losses cannot be used to offset earned income. A loss from one business, however,

can be used to offset net profits from another business.

1a

W-2 Earnings

(Attach copy of W-2's) Use State Wages Per W-2 Form

1a

1b

Other Taxable Earned Income (DO NOT include interest, dividends, or unemployment compensation)

1b

1c

Employee Business Expenses (Attach PA Schedule UE)

1c

1d

TAXABLE COMPENSATION (Add Lines 1a, 1b minus Line 1c)

1d

2.

Net Profit from Business, Profession, or Farm (Attach copies of Federal Schedules C, F) & PA RK-1.

2

(If less than zero, enter zero)

3.

TOTAL TAXABLE EARNED INCOME (Add Lines 1d, 2)

3

4.

TAX LIABILITY: 1% of Line 3 (Multiply Line 3 by .01)

4

5

5.

Total Local Taxes Withheld

(DO NOT include City of Altoona .2% Non-Resident Tax)

6.

Quarterly Payments and/or Applied Credits from 2008 Return

6

7.

TOTAL WITHHOLDINGS AND PAYMENTS (Add Lines 5, 6)

7

8.

EARNED INCOME TAX DUE (Subtract Line 7 from Line 4) If less than zero, enter as negative

8

9.

FLAT RATE OCCUPATION TAX (See Instructions) $1.00 Penalty if paid after April 15, 2010

9

10

00

10.

PENALTY AND INTEREST - 1% PER MONTH OF LINE 8 IF PAID AFTER APRIL 15, 2010

10

11

TOTAL EARNED INCOME AND FLAT RATE OCCUPATION TAX DUE (Add Lines 8, 9, 10)

(

HASD TAX OFFICE) -- $20.00 SERVICE CHARGE FOR ALL RETURNED CHECKS

11.

CHECKS PAYABLE TO

AMOUNTS UNDER $1.00 ARE NOT DUE OR REFUNDABLE

OVERPAYMENT: If Line 11 is less than zero, Check appropriate box

:

‘

‘

Credit my 2010 Tax Return

Refund

THIS RETURN MUST BE FILED BY APRIL 15, 2010

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief it is true,

correct and complete.

SIGN HERE:___________________________________________________

_______________

______________________________________________

______________

Your Signature

Date

Signature of preparer, other than taxpayer, based on

Date

all information of which preparer has any knowledge.

Telephone Number ____________________________

Telephone Number ___________________________

THIS FORM MUST BE RETURNED EVEN IF YOU HAVE NO EARNED INCOME TO REPORT

RETAIN YELLOW COPY FOR YOUR RECORDS

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1