Minnesota Tax Court Form 7 - Real Property Tax Petition

ADVERTISEMENT

Last revised 4/02

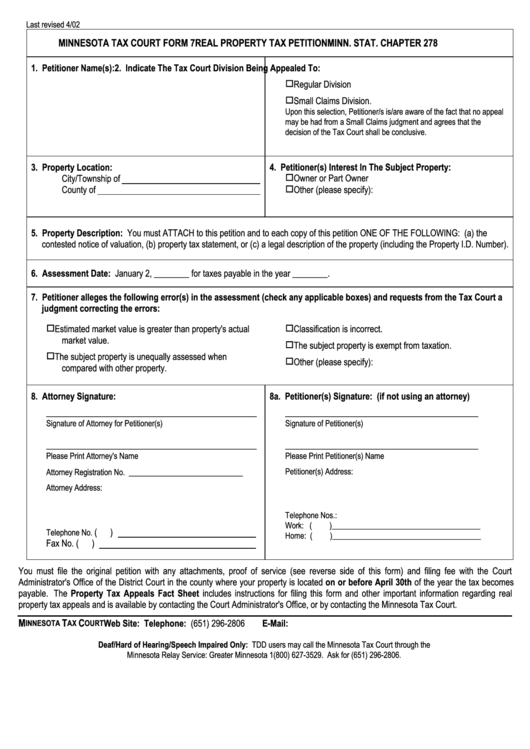

MINNESOTA TAX COURT FORM 7

REAL PROPERTY TAX PETITION

MINN. STAT. CHAPTER 278

1. Petitioner Name(s):

2. Indicate The Tax Court Division Being Appealed To:

o Regular Division

o Small Claims Division.

Upon this selection, Petitioner/s is/are aware of the fact that no appeal

may be had from a Small Claims judgment and agrees that the

decision of the Tax Court shall be conclusive.

3. Property Location:

4. Petitioner(s) Interest In The Subject Property:

o Owner or Part Owner

City/Township of

o Other (please specify):

County of

5. Property Description: You must ATTACH to this petition and to each copy of this petition ONE OF THE FOLLOWING: (a) the

contested notice of valuation, (b) property tax statement, or (c) a legal description of the property (including the Property I.D. Number).

6. Assessment Date: January 2, ________ for taxes payable in the year ________.

7. Petitioner alleges the following error(s) in the assessment (check any applicable boxes) and requests from the Tax Court a

judgment correcting the errors:

o Estimated market value is greater than property's actual

o Classification is incorrect.

market value.

o The subject property is exempt from taxation.

o The subject property is unequally assessed when

o Other (please specify):

compared with other property.

8. Attorney Signature:

8a. Petitioner(s) Signature: (if not using an attorney)

________________________________________________

____________________________________________

Signature of Attorney for Petitioner(s)

Signature of Petitioner(s)

________________________________________________

____________________________________________

Please Print Attorney's Name

Please Print Petitioner(s) Name

__________________________

Petitioner(s) Address:

Attorney Registration No.

Attorney Address:

Telephone Nos.:

Work: (

)

______________________________________

(

)

Telephone No.

Home: (

)

______________________________________

Fax No. (

)

You must file the original petition with any attachments, proof of service (see reverse side of this form) and filing fee with the Court

Administrator's Office of the District Court in the county where your property is located on or before April 30th of the year the tax becomes

payable. The Property Tax Appeals Fact Sheet includes instructions for filing this form and other important information regarding real

property tax appeals and is available by contacting the Court Administrator's Office, or by contacting the Minnesota Tax Court.

M

T

C

Web Site:

Telephone: (651) 296-2806

E-Mail: info@taxcourt.state.mn.us

INNESOTA

AX

OURT

Deaf/Hard of Hearing/Speech Impaired Only: TDD users may call the Minnesota Tax Court through the

Minnesota Relay Service: Greater Minnesota 1(800) 627-3529. Ask for (651) 296-2806.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2