Form It-141 - West Virginia Fiduciary Income Tax Return

ADVERTISEMENT

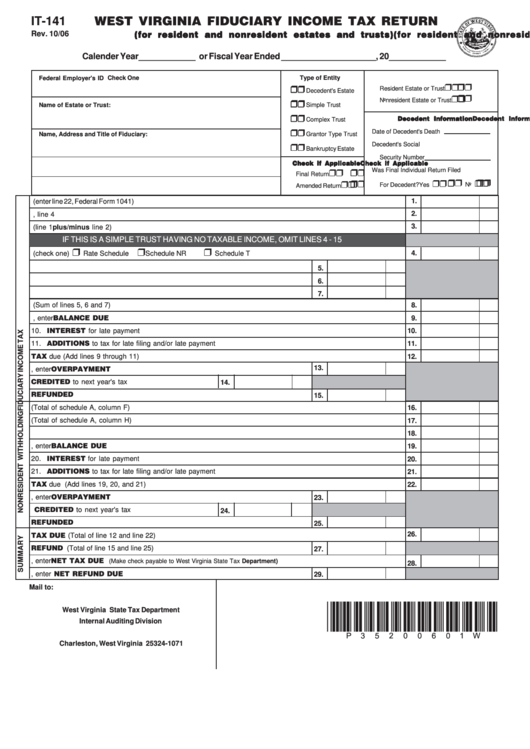

IT-141

WEST VIRGINIA FIDUCIARY INCOME TAX RETURN

Rev. 10/06

(for resident and nonresident estates and trusts)

(for resident and nonresident estates and trusts)

(for resident and nonresident estates and trusts)

(for resident and nonresident estates and trusts)

(for resident and nonresident estates and trusts)

Calender Year____________ or Fiscal Year Ended ____________________, 20____________

Type of Entity

Check One

Federal Employer's ID No.of Estate or Trust

❒ ❒ ❒ ❒ ❒

❒ ❒ ❒ ❒ ❒

Resident Estate or Trust

Decedent's Estate

❒ ❒ ❒ ❒ ❒

Nonresident Estate or Trust

❒ ❒ ❒ ❒ ❒

Name of Estate or Trust:

Simple Trust

❒ ❒ ❒ ❒ ❒

Decedent Information

Decedent Information

Decedent Information

Decedent Information

Decedent Information

Complex Trust

❒ ❒ ❒ ❒ ❒

Date of Decedent's Death

Name, Address and Title of Fiduciary:

Grantor Type Trust

❒ ❒ ❒ ❒ ❒

Decedent's Social

Bankruptcy Estate

Security Number

Check if Applicable

Check if Applicable

Check if Applicable

Check if Applicable

Check if Applicable

❒ ❒ ❒ ❒ ❒

Was Final Individual Return Filed

Final Return

❒ ❒ ❒ ❒ ❒

❒ ❒ ❒ ❒ ❒

❒ ❒ ❒ ❒ ❒

For Decedent?

Yes

No

Amended Return

1.

1.

Federal Taxable Income (enter line 22, Federal Form 1041)

2.

2.

West Virginia net fiduciary modifications from schedule B, line 4

3.

3.

West Virginia taxable income (line 1 plus/minus line 2)

IF THIS IS A SIMPLE TRUST HAVING NO TAXABLE INCOME, OMIT LINES 4 - 15

❒

❒

❒

4.

4.

West Virginia Tax (check one)

Rate Schedule

Schedule NR

Schedule T

5.

Business Credits

5.

6.

Credit for income taxes paid to other states

6.

7.

Previous payments/Payments with extension of time

7.

8.

Total credits (Sum of lines 5, 6 and 7)

8.

9.

If line 4 is greater than line 8, enter BALANCE DUE

9.

10. INTEREST for late payment

10.

11. ADDITIONS to tax for late filing and/or late payment

11.

12. Total TAX due (Add lines 9 through 11)

12.

13.

13. If line 8 is greater than line 4, enter OVERPAYMENT

14. Amount to be CREDITED to next year's tax

14.

15. Amount to be REFUNDED

15.

16. Income subject to withholding (Total of schedule A, column F)

16.

17. West Virginia income tax withheld for nonresident beneficiaries (Total of schedule A, column H)

17.

18. Previous payments /Payments with extension of time

18.

19. If line 17 is greater than line 18, enter BALANCE DUE

19.

20. INTEREST for late payment

20.

21. ADDITIONS to tax for late filing and/or late payment

21.

22. Total TAX due (Add lines 19, 20, and 21)

22.

23. If line 18 is greater than line 17, enter OVERPAYMENT

23.

24. Amount to be CREDITED to next year's tax

24.

25. Amount to be REFUNDED

25.

26.

26. Combined TAX DUE (Total of line 12 and line 22)

27. Combined REFUND (Total of line 15 and line 25)

27.

28. If line 26 is greater than line 27, enter NET TAX DUE

(Make check payable to West Virginia State Tax Department)

28.

29

. If line 27 is greater than line 26, enter NET REFUND DUE

29.

Mail to:

West Virginia State Tax Department

*P35200601W*

Internal Auditing Division

P.O. Box 1071

Charleston, West Virginia 25324-1071

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3