Form Tr-824 - Application Form For Fiduciary E-File And/or Fiduciary Electronic Payment Programs

ADVERTISEMENT

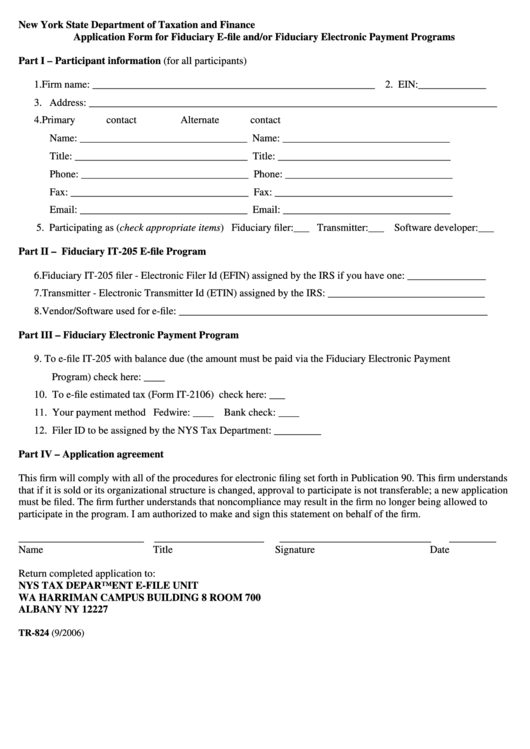

New York State Department of Taxation and Finance

Application Form for Fiduciary E-file and/or Fiduciary Electronic Payment Programs

Part I – Participant information (for all participants)

1. Firm name: ______________________________________________________ 2. EIN:_____________

3. Address: ______________________________________________________________________________

4. Primary contact

Alternate contact

Name: ________________________________

Name: ________________________________

Title: _________________________________

Title: _________________________________

Phone: ________________________________

Phone: ________________________________

Fax: __________________________________

Fax: __________________________________

Email: ________________________________

Email: ________________________________

5. Participating as (check appropriate items) Fiduciary filer:___ Transmitter:___ Software developer:___

Part II – Fiduciary IT-205 E-file Program

6. Fiduciary IT-205 filer - Electronic Filer Id (EFIN) assigned by the IRS if you have one: _______________

7. Transmitter - Electronic Transmitter Id (ETIN) assigned by the IRS: ______________________________

8. Vendor/Software used for e-file: ___________________________________________________________

Part III – Fiduciary Electronic Payment Program

9. To e-file IT-205 with balance due (the amount must be paid via the Fiduciary Electronic Payment

Program) check here: ____

10. To e-file estimated tax (Form IT-2106) check here: ___

11. Your payment method Fedwire: ____ Bank check: ____

12. Filer ID to be assigned by the NYS Tax Department: _________

Part IV – Application agreement

This firm will comply with all of the procedures for electronic filing set forth in Publication 90. This firm understands

that if it is sold or its organizational structure is changed, approval to participate is not transferable; a new application

must be filed. The firm further understands that noncompliance may result in the firm no longer being allowed to

participate in the program. I am authorized to make and sign this statement on behalf of the firm.

________________________ _____________________

_____________________________

_________

Name

Title

Signature

Date

Return completed application to:

NYS TAX DEPARTMENT E-FILE UNIT

WA HARRIMAN CAMPUS BUILDING 8 ROOM 700

ALBANY NY 12227

TR-824 (9/2006)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1