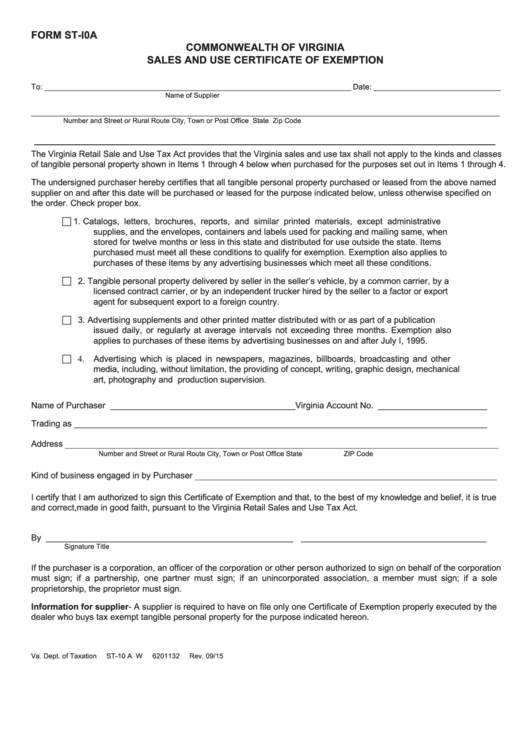

FORM ST-I0A

COMMONWEALTH OF VIRGINIA

SALES AND USE CERTIFICATE OF EXEMPTION

To:_______________________________________________________________________ Date:_______________________________

_

Name_of_Supplier

___________________________________________________________________________________________________________

_

Number_and_Street_or_Rural_Route_

City,_Town_or_Post_Office__

State__

Zip_Code

The_Virginia_Retail_Sale_and_Use_Tax_Act_provides_that_the_Virginia_sales_and_use_tax_shall_not_apply_to_the_kinds_and_classes_

of_tangible_personal_property_shown_in_Items_1_through_4_below_when_purchased_for_the_purposes_set_out_in_Items_1_through_4.

The_undersigned_purchaser_hereby_certifies_that_all_tangible_personal_property_purchased_or_leased_from_the_above_named_

supplier_on_and_after_this_date_will_be_purchased_or_leased_for_the_purpose_indicated_below,_unless_otherwise_specified_on_

the_order._Check_proper_box.

c_ 1._ Catalogs,_ letters,_ brochures,_ reports,_ and_ similar_ printed_ materials,_ except_ administrative_

supplies,_and_the_envelopes,_containers_and_labels_used_for_packing_and_mailing_same,_when_

stored_for_twelve_months_or_less_in_this_state_and_distributed_for_use_outside_the_state._Items_

purchased_must_meet_all_these_conditions_to_qualify_for_exemption._Exemption_also_applies_to_

purchases_of_these_items_by_any_advertising_businesses_which_meet_all_these_conditions.

c_ 2._ Tangible_personal_property_delivered_by_seller_in_the_seller’s_vehicle,_by_a_common_carrier,_by_a_

licensed_contract_carrier,_or_by_an_independent_trucker_hired_by_the_seller_to_a_factor_or_export_

agent_for_subsequent_export_to_a_foreign_country.

c_ 3._ Advertising_supplements_and_other_printed_matter_distributed_with_or_as_part_of_a_publication_

issued_ daily,_ or_ regularly_ at_ average_ intervals_ not_ exceeding_ three_ months._ Exemption_ also_

applies_to_purchases_of_these_items_by_advertising_businesses_on_and_after_July_I,_1995.

c_ 4. Advertising_ which_ is_ placed_ in_ newspapers,_ magazines,_ billboards,_ broadcasting_ and_ other_

media,_including,_without_limitation,_the_providing_of_concept,_writing,_graphic_design,_mechanical_

art,_photography_and__production_supervision.

Name_of_Purchaser__ _ ______________________________________ Virginia_Account_No._ _______________________

Trading_as________________________________________________________________________________________

Address ___________________________________________________________________________________________________

Number_and_Street_or_Rural_Route_

City,_Town_or_Post_Office_

State_

ZIP_Code

Kind_of_business_engaged_in_by_Purchaser _____________________________________________________________________

I_certify_that_I_am_authorized_to_sign_this_Certificate_of_Exemption_and_that,_to_the_best_of_my_knowledge_and_belief,_it_is_true_

and_correct,made_in_good_faith,_pursuant_to_the_Virginia_Retail_Sales_and_Use_Tax_Act.

By______________________________________________________ _ _ _ ______________________________________

_

_

Signature_

Title

If_the_purchaser_is_a_corporation,_an_officer_of_the_corporation_or_other_person_authorized_to_sign_on_behalf_of_the_corporation_

must_ sign;_ if_ a_ partnership,_ one_ partner_ must_ sign;_ if_ an_ unincorporated_ association,_ a_ member_ must_ sign;_ if_ a_ sole_

proprietorship,_the_proprietor_must_sign.

Information for supplier-_A_supplier_is_required_to_have_on_file_only_one_Certificate_of_Exemption_properly_executed_by_the_

dealer_who_buys_tax_exempt_tangible_personal_property_for_the_purpose_indicated_hereon.

Va._Dept._of_Taxation_____ST-10_A__W_____6201132_____Rev._09/15

1

1