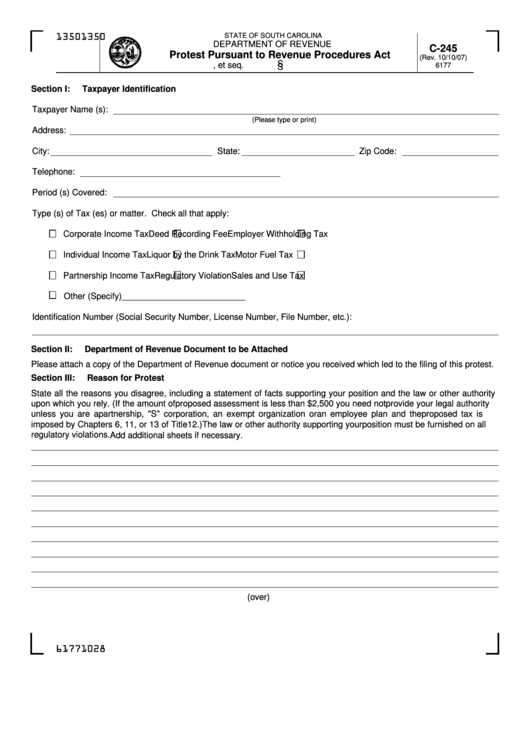

Form C-245 - Protest Pursuant To Revenue Procedures Act

ADVERTISEMENT

STATE OF SOUTH CAROLINA

1350

1350

DEPARTMENT OF REVENUE

C-245

Protest Pursuant to Revenue Procedures Act

(Rev. 10/10/07)

S S

S.C. Code Ann.

12-60-10, et seq.

6177

Section I:

Taxpayer Identification

Taxpayer Name (s):

(Please type or print)

Address:

City:

State:

Zip Code:

Telephone:

Period (s) Covered:

Type (s) of Tax (es) or matter. Check all that apply:

Corporate Income Tax

Deed Recording Fee

Employer Withholding Tax

Individual Income Tax

Liquor by the Drink Tax

Motor Fuel Tax

Partnership Income Tax

Regulatory Violation

Sales and Use Tax

Other (Specify)__________________________

Identification Number (Social Security Number, License Number, File Number, etc.):

Section II:

Department of Revenue Document to be Attached

Please attach a copy of the Department of Revenue document or notice you received which led to the filing of this protest.

Section III:

Reason for Protest

State all the reasons you disagree, including a statement of facts supporting your position and the law or other authority

upon which you rely. (If the amount of proposed assessment is less than $2,500 you need not provide your legal authority

unless you are a partnership, "S" corporation, an exempt organization or an employee plan and the proposed tax is

imposed by Chapters 6, 11, or 13 of Title 12.) The law or other authority supporting your position must be furnished on all

regulatory violations. Add additional sheets if necessary.

(over)

61771028

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2