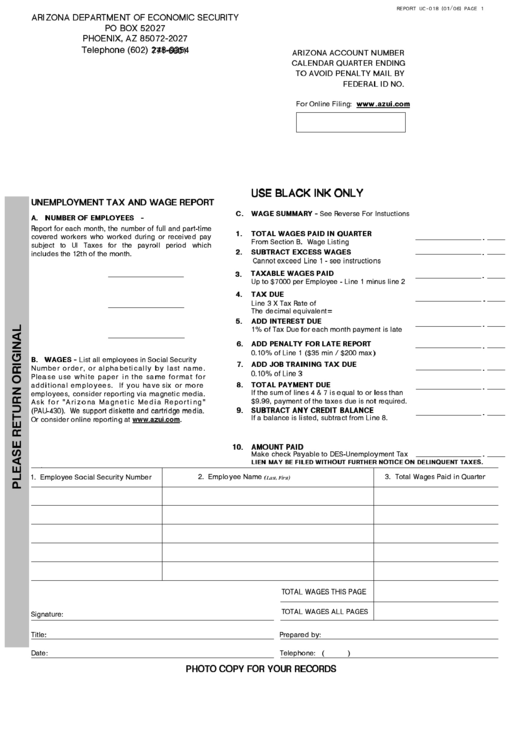

REPORT UC-018 (01/06) PAGE 1

ARIZONA DEPARTMENT OF ECONOMIC SECURITY

PO BOX 52027

PHOENIX, AZ 85072-2027

Telephone (602) 248-9354

ARIZONA ACCOUNT NUMBER

771-6601

CALENDAR QUARTER ENDING

TO AVOID PENALTY MAIL BY

FEDERAL ID NO.

For Online Filing:

USE BLACK INK ONLY

UNEMPLOYMENT TAX AND WAGE REPORT

C. WAGE SUMMARY - See Reverse For Instuctions

A.

NUMBER

OF

EMPLOYEES

-

Report

for

each

month,

the

number

of

full

and

part-time

1.

TOTAL WAGES PAID IN QUARTER

covered

workers

who

worked

during

or

received

pay

.

From Section B. Wage Listing

subject

to

UI

Taxes

for

the

payroll

period

which

2. SUBTRACT EXCESS WAGES

.

includes

the

12th

of

the

month.

Cannot exceed Line 1 - see instructions

3. TAXABLE WAGES PAID

.

Up to $7000 per Employee - Line 1 minus line 2

4.

TAX DUE

.

Line 3 X Tax Rate of

The decimal equivalent=

5.

ADD INTEREST DUE

.

1% of Tax Due for each month payment is late

6.

ADD PENALTY FOR LATE REPORT

.

0.10% of Line 1 ($35 min / $200 max)

B. WAGES - List all employees in Social Security

7.

ADD JOB TRAINING TAX DUE

.

Number order, or alphabetically by last name.

0.10% of Line 3

Please use white paper in the same format for

8.

TOTAL PAYMENT DUE

additional employees. If you have six or more

.

If the sum of lines 4 & 7 is equal to or less than

employees, consider reporting via magnetic media.

$9.99, payment of the taxes due is not required.

Ask for "Arizona Magnetic Media Reporting"

9.

SUBTRACT ANY CREDIT BALANCE

(PAU-430). We support diskette and cartridge media.

.

If a balance is listed, subtract from Line 8.

Or consider online reporting at .

10.

AMOUNT PAID

.

Make check Payable to DES-Unemployment Tax

LIEN MAY BE FILED WITHOUT FURTHER NOTICE ON DELINQUENT TAXES.

1. Employee Social Security Number

2. Employee Name

3. Total Wages Paid in Quarter

(Last, First)

TOTAL WAGES THIS PAGE

TOTAL WAGES ALL PAGES

Signature:

Title:

Prepared by:

Date:

Telephone: (

)

PHOTO COPY FOR YOUR RECORDS

1

1 2

2