Change Document Font | Size

Check Spelling Email Form Save Form

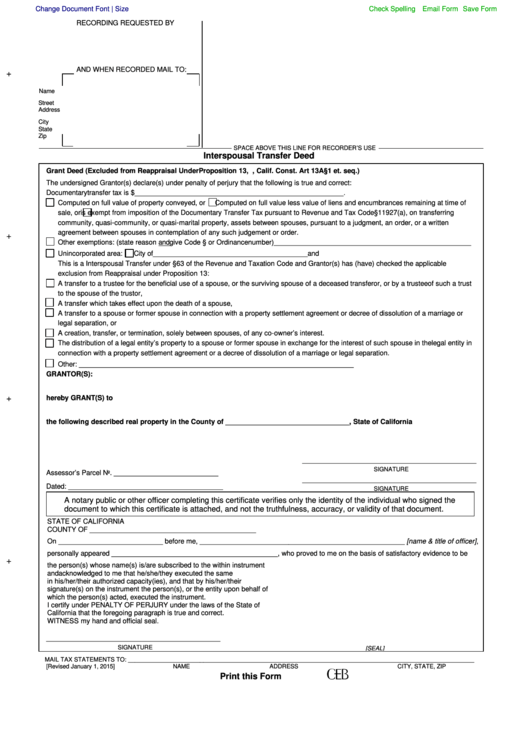

RECORDING REQUESTED BY

AND WHEN RECORDED MAIL TO:

+

Name

Street

Address

City

State

Zip

SPACE ABOVE THIS LINE FOR RECORDER’S USE

Interspousal Transfer Deed

Grant Deed (Excluded from Reappraisal Under Proposition 13, i.e., Calif. Const. Art 13A§1 et. seq.)

The undersigned Grantor(s) declare(s) under penalty of perjury that the following is true and correct:

Documentary transfer tax is $______________________________________________________.

Computed on full value of property conveyed, or

Computed on full value less value of liens and encumbrances remaining at time of

sale, or

is exempt from imposition of the Documentary Transfer Tax pursuant to Revenue and Tax Code §11927(a), on transferring

community, quasi-community, or quasi-marital property, assets between spouses, pursuant to a judgment, an order, or a written

agreement between spouses in contemplation of any such judgement or order.

+

Other exemptions: (state reason and give Code § or Ordinance number) ___________________________________________________

Unincorporated area:

City of ________________________________________and

This is a Interspousal Transfer under §63 of the Revenue and Taxation Code and Grantor(s) has (have) checked the applicable

exclusion from Reappraisal under Proposition 13:

A transfer to a trustee for the beneficial use of a spouse, or the surviving spouse of a deceased transferor, or by a trustee of such a trust

to the spouse of the trustor,

A transfer which takes effect upon the death of a spouse,

A transfer to a spouse or former spouse in connection with a property settlement agreement or decree of dissolution of a marriage or

legal separation, or

A creation, transfer, or termination, solely between spouses, of any co-owner’s interest.

The distribution of a legal entity’s property to a spouse or former spouse in exchange for the interest of such spouse in the legal entity in

connection with a property settlement agreement or a decree of dissolution of a marriage or legal separation.

Other: _______________________________________________________________________

GRANTOR(S):

+

hereby GRANT(S) to

the following described real property in the County of ________________________________, State of California

_____________________________________________

SIGNATURE

Assessor’s Parcel No. ___________________________

_____________________________________________

Dated: ________________________________________

SIGNATURE

A notary public or other officer completing this certificate verifies only the identity of the individual who signed the

document to which this certificate is attached, and not the truthfulness, accuracy, or validity of that document.

STATE OF CALIFORNIA

COUNTY OF ___________________________________________

On ___________________________ before me, _____________________________________________________ [name & title of officer],

personally appeared ___________________________________________, who proved to me on the basis of satisfactory evidence to be

+

the person(s) whose name(s) is/are subscribed to the within instrument

and acknowledged to me that he/she/they executed the same

in his/her/their authorized capacity(ies), and that by his/her/their

signature(s) on the instrument the person(s), or the entity upon behalf of

which the person(s) acted, executed the instrument.

I certify under PENALTY OF PERJURY under the laws of the State of

California that the foregoing paragraph is true and correct.

WITNESS my hand and official seal.

_____________________________________________

SIGNATURE

[SEAL]

MAIL TAX STATEMENTS TO: __________________________________________________________________________________________________________

[Revised January 1, 2015]

NAME

ADDRESS

CITY, STATE, ZIP

Print this Form

1

1