Form Ol-3 - Application For Automatic Extension Of Time To File City Of Covington Net Profit License Return

ADVERTISEMENT

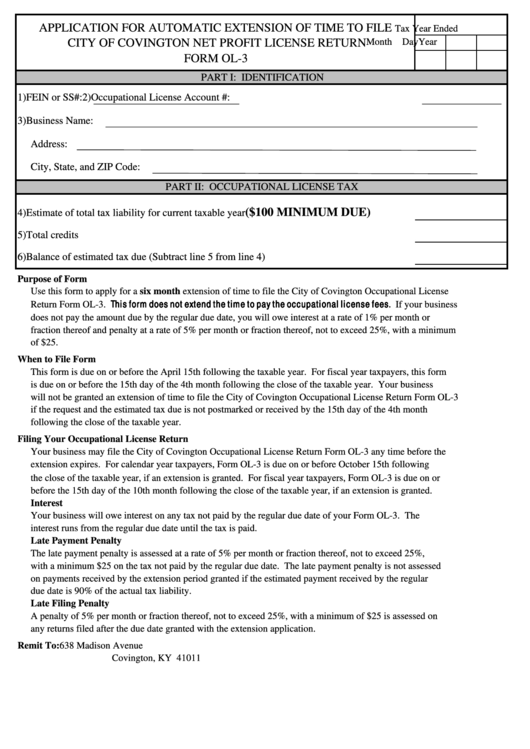

APPLICATION FOR AUTOMATIC EXTENSION OF TIME TO FILE

Tax Year Ended

CITY OF COVINGTON NET PROFIT LICENSE RETURN

Month

Day

Year

FORM OL-3

PART I: IDENTIFICATION

1) FEIN or SS#:

2) Occupational License Account #:

3) Business Name:

Address:

City, State, and ZIP Code:

PART II: OCCUPATIONAL LICENSE TAX

($100 MINIMUM DUE)

4) Estimate of total tax liability for current taxable year

5) Total credits

6) Balance of estimated tax due (Subtract line 5 from line 4)

Purpose of Form

Use this form to apply for a six month extension of time to file the City of Covington Occupational License

Return Form OL-3. This form does not extend the time to pay the occupational license fees.

If your business

does not pay the amount due by the regular due date, you will owe interest at a rate of 1% per month or

fraction thereof and penalty at a rate of 5% per month or fraction thereof, not to exceed 25%, with a minimum

of $25.

When to File Form

This form is due on or before the April 15th following the taxable year. For fiscal year taxpayers, this form

is due on or before the 15th day of the 4th month following the close of the taxable year. Your business

will not be granted an extension of time to file the City of Covington Occupational License Return Form OL-3

if the request and the estimated tax due is not postmarked or received by the 15th day of the 4th month

following the close of the taxable year.

Filing Your Occupational License Return

Your business may file the City of Covington Occupational License Return Form OL-3 any time before the

extension expires. For calendar year taxpayers, Form OL-3 is due on or before October 15th following

the close of the taxable year, if an extension is granted. For fiscal year taxpayers, Form OL-3 is due on or

before the 15th day of the 10th month following the close of the taxable year, if an extension is granted.

Interest

Your business will owe interest on any tax not paid by the regular due date of your Form OL-3. The

interest runs from the regular due date until the tax is paid.

Late Payment Penalty

The late payment penalty is assessed at a rate of 5% per month or fraction thereof, not to exceed 25%,

with a minimum $25 on the tax not paid by the regular due date. The late payment penalty is not assessed

on payments received by the extension period granted if the estimated payment received by the regular

due date is 90% of the actual tax liability.

Late Filing Penalty

A penalty of 5% per month or fraction thereof, not to exceed 25%, with a minimum of $25 is assessed on

any returns filed after the due date granted with the extension application.

Remit To:

638 Madison Avenue

Covington, KY 41011

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1