Form Tc-69 - Business And Tax Registration October 2001

ADVERTISEMENT

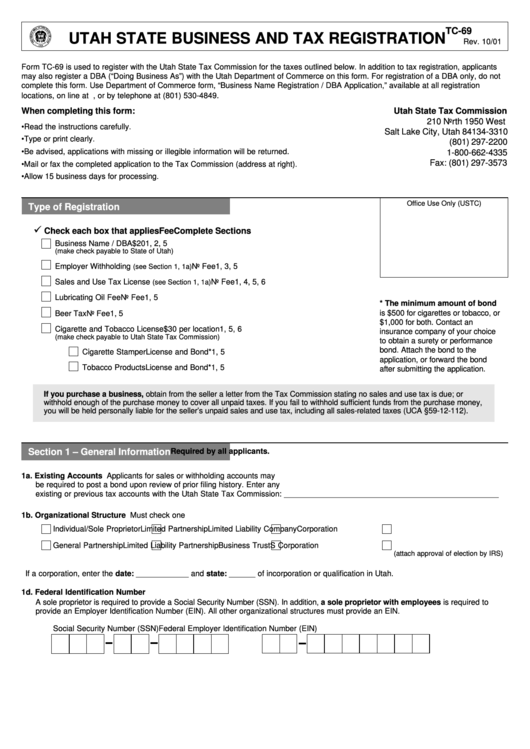

TC-69

UTAH STATE BUSINESS AND TAX REGISTRATION

Rev. 10/01

Form TC-69 is used to register with the Utah State Tax Commission for the taxes outlined below. In addition to tax registration, applicants

may also register a DBA (“Doing Business As”) with the Utah Department of Commerce on this form. For registration of a DBA only, do not

complete this form. Use Department of Commerce form, “Business Name Registration / DBA Application,” available at all registration

locations, on line at , or by telephone at (801) 530-4849.

When completing this form:

Utah State Tax Commission

210 North 1950 West

• Read the instructions carefully.

Salt Lake City, Utah 84134-3310

• Type or print clearly.

(801) 297-2200

• Be advised, applications with missing or illegible information will be returned.

1-800-662-4335

Fax: (801) 297-3573

• Mail or fax the completed application to the Tax Commission (address at right).

• Allow 15 business days for processing.

Office Use Only (USTC)

Type of Registration

ü

Check each box that applies

Fee

Complete Sections

Business Name / DBA

$20

1, 2, 5

(make check payable to State of Utah)

Employer Withholding

No Fee

1, 3, 5

(see Section 1, 1a)

Sales and Use Tax License

No Fee

1, 4, 5, 6

(see Section 1, 1a)

Lubricating Oil Fee

No Fee

1, 5

* The minimum amount of bond

is $500 for cigarettes or tobacco, or

Beer Tax

No Fee

1, 5

$1,000 for both. Contact an

Cigarette and Tobacco License

$30 per location

1, 5, 6

insurance company of your choice

(make check payable to Utah State Tax Commission)

to obtain a surety or performance

bond. Attach the bond to the

Cigarette Stamper

License and Bond*

1, 5

application, or forward the bond

Tobacco Products

License and Bond*

1, 5

after submitting the application.

If you purchase a business, obtain from the seller a letter from the Tax Commission stating no sales and use tax is due; or

withhold enough of the purchase money to cover all unpaid taxes. If you fail to withhold sufficient funds from the purchase money,

you will be held personally liable for the seller’s unpaid sales and use tax, including all sales-related taxes (UCA §59-12-112).

Section 1 – General Information

Required by all applicants.

1a. Existing Accounts Applicants for sales or withholding accounts may

be required to post a bond upon review of prior filing history. Enter any

existing or previous tax accounts with the Utah State Tax Commission: _________________________________________________

1b. Organizational Structure Must check one

Individual/Sole Proprietor

Limited Partnership

Limited Liability Company

Corporation

General Partnership

Limited Liability Partnership

Business Trust

S Corporation

(attach approval of election by IRS)

1c. Incorporation Date If a corporation, enter the date: ____________ and state: ______ of incorporation or qualification in Utah.

1d. Federal Identification Number

A sole proprietor is required to provide a Social Security Number (SSN). In addition, a sole proprietor with employees is required to

provide an Employer Identification Number (EIN). All other organizational structures must provide an EIN.

Social Security Number (SSN)

Federal Employer Identification Number (EIN)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4