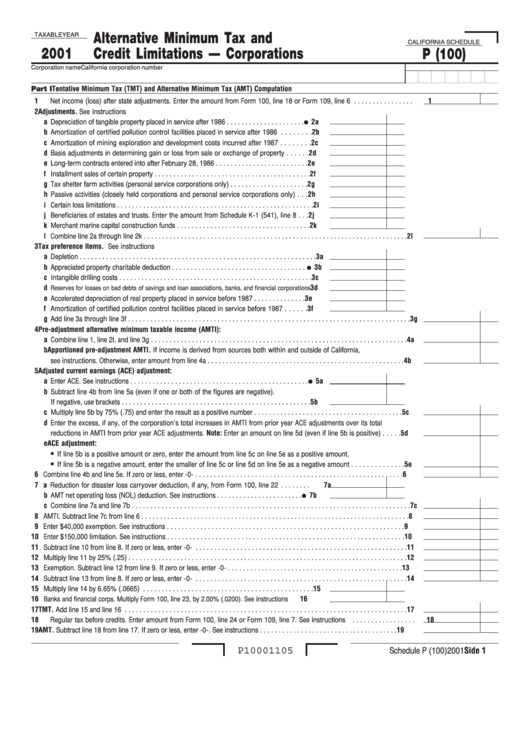

California Schedule P (100) - Alternative Minimum Tax And Credit Limitations - Corporations - 2001

ADVERTISEMENT

Alternative Minimum Tax and

TAXABLE YEAR

CALIFORNIA SCHEDULE

2001

Credit Limitations — Corporations

P (100)

Corporation name

California corporation number

Part I

Tentative Minimum Tax (TMT) and Alternative Minimum Tax (AMT) Computation

1 Net income (loss) after state adjustments. Enter the amount from Form 100, line 18 or Form 109, line 6 . . . . . . . . . . . . . . . . 1

2 Adjustments. See instructions

a Depreciation of tangible property placed in service after 1986 . . . . . . . . . . . . . . . . . . . . .

2a

b Amortization of certified pollution control facilities placed in service after 1986 . . . . . . . . 2b

c Amortization of mining exploration and development costs incurred after 1987 . . . . . . . . 2c

d Basis adjustments in determining gain or loss from sale or exchange of property . . . . . . 2d

e Long-term contracts entered into after February 28, 1986 . . . . . . . . . . . . . . . . . . . . . . . . . 2e

f Installment sales of certain property . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2f

g Tax shelter farm activities (personal service corporations only) . . . . . . . . . . . . . . . . . . . . . 2g

h Passive activities (closely held corporations and personal service corporations only) . . . 2h

i Certain loss limitations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2i

j Beneficiaries of estates and trusts. Enter the amount from Schedule K-1 (541), line 8 . . . 2j

k Merchant marine capital construction funds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2k

l Combine line 2a through line 2k . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2l

3 Tax preference items. See instructions

a Depletion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3a

b Appreciated property charitable deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3b

c Intangible drilling costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3c

d

3d

Reserves for losses on bad debts of savings and loan associations, banks, and financial corporations

e Accelerated depreciation of real property placed in service before 1987 . . . . . . . . . . . . . . 3e

f Amortization of certified pollution control facilities placed in service before 1987 . . . . . . 3f

g Add line 3a through line 3f . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3g

4 Pre-adjustment alternative minimum taxable income (AMTI):

a Combine line 1, line 2l, and line 3g . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4a

b Apportioned pre-adjustment AMTI. If income is derived from sources both within and outside of California,

see instructions. Otherwise, enter amount from line 4a . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4b

5 Adjusted current earnings (ACE) adjustment:

a Enter ACE. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5a

b Subtract line 4b from line 5a (even if one or both of the figures are negative).

If negative, use brackets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5b

c Multiply line 5b by 75% (.75) and enter the result as a positive number . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5c

d Enter the excess, if any, of the corporation’s total increases in AMTI from prior year ACE adjustments over its total

reductions in AMTI from prior year ACE adjustments. Note: Enter an amount on line 5d (even if line 5b is positive) . . . . . 5d

e ACE adjustment:

•

If line 5b is a positive amount or zero, enter the amount from line 5c on line 5e as a positive amount.

•

If line 5b is a negative amount, enter the smaller of line 5c or line 5d on line 5e as a negative amount . . . . . . . . . . . . . . 5e

6 Combine line 4b and line 5e. If zero or less, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 a Reduction for disaster loss carryover deduction, if any, from Form 100, line 22 . . . . . . . . 7a

b AMT net operating loss (NOL) deduction. See instructions . . . . . . . . . . . . . . . . . . . . . . .

7b

c Combine line 7a and line 7b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7c

8 AMTI. Subtract line 7c from line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Enter $40,000 exemption. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Enter $150,000 limitation. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Subtract line 10 from line 8. If zero or less, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Multiply line 11 by 25% (.25) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Exemption. Subtract line 12 from line 9. If zero or less, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Subtract line 13 from line 8. If zero or less, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15 Multiply line 14 by 6.65% (.0665) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16

16

Banks and financial corps. Multiply Form 100, line 23, by 2.00% (.0200). See instructions . . . . . . .

17 TMT. Add line 15 and line 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

18 Regular tax before credits. Enter amount from Form 100, line 24 or Form 109, line 7. See instructions . . . . . . . . . . . . . . . . . 18

19 AMT. Subtract line 18 from line 17. If zero or less, enter -0-. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

P10001105

Schedule P (100) 2001 Side 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2