Form Ar1100ct - Corporation Income Tax Return - 2014

ADVERTISEMENT

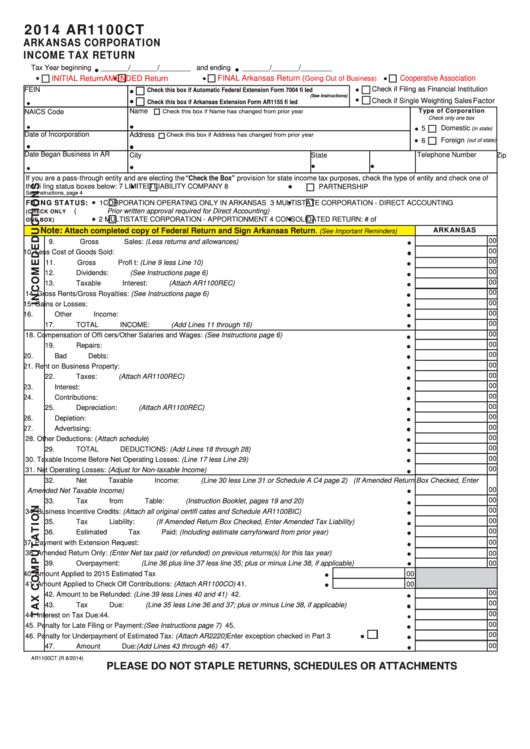

2014 AR1100CT

ARKANSAS CORPORATION

INCOME TAX RETURN

Tax Year beginning

_______/_______/________ and ending

_______/_______/________

AMENDED Return

FINAL Arkansas Return (

Cooperative Association

INITIAL Return

Going Out of Business

)

Check if Filing as Financial Institution

FEIN

Check this box if Automatic Federal Extension Form 7004 fi led

(See Instructions)

Check if Single Weighting Sales Factor

Check this box if Arkansas Extension Form AR1155 fi led

Type of Corporation

Name

NAICS Code

Check this box if Name has changed from prior year

Check only one box

Domestic

5

(in state)

Date of Incorporation

Address

Check this box if Address has changed from prior year

Foreign

6

(out of state)

Date Began Business in AR

Telephone Number

City

State

Zip

If you are a pass-through entity and are electing the “Check the Box” provision for state income tax purposes, check the type of entity and check one of

the fi ling status boxes below:

7

LIMITED LIABILITY COMPANY

8

PARTNERSHIP

See Instructions, page 4

FILING STATUS:

1

CORPORATION OPERATING ONLY IN ARKANSAS

3

MULTISTATE CORPORATION - DIRECT ACCOUNTING

(CHECK ONLY

(Prior written approval required for Direct Accounting)

ONE BOX)

2

MULTISTATE CORPORATION - APPORTIONMENT

4

CONSOLIDATED RETURN: # of corp.entities in AR___

ARKANSAS

Note:

Attach completed copy of Federal Return and Sign Arkansas Return.

(See Important Reminders)

00

9. Gross Sales: (Less returns and allowances) ...........................................................................................................9.

00

10. Less Cost of Goods Sold: ......................................................................................................................................10.

00

11. Gross Profi t: (Line 9 less Line 10) ..........................................................................................................................11.

00

12. Dividends: (See Instructions page 6) .....................................................................................................................12.

00

13. Taxable Interest: (Attach AR1100REC) ..................................................................................................................13.

00

14. Gross Rents/Gross Royalties: (See Instructions page 6) ......................................................................................14.

00

15. Gains or Losses: ....................................................................................................................................................15.

00

16. Other Income: ........................................................................................................................................................16.

00

17. TOTAL INCOME: (Add Lines 11 through 16) .........................................................................................................17.

00

18. Compensation of Offi cers/Other Salaries and Wages: (See Instructions page 6) .................................................18.

00

19. Repairs: ..................................................................................................................................................................19.

00

20. Bad Debts: .............................................................................................................................................................20.

00

21. Rent on Business Property: ...................................................................................................................................21.

00

22. Taxes: (Attach AR1100REC) ..................................................................................................................................22.

00

23. Interest: ..................................................................................................................................................................23.

00

24. Contributions: .........................................................................................................................................................24.

00

25. Depreciation: (Attach AR1100REC) .......................................................................................................................25.

00

26. Depletion: ...............................................................................................................................................................26.

00

27. Advertising: ............................................................................................................................................................27.

00

28. Other Deductions: (Attach schedule) .....................................................................................................................28.

00

29. TOTAL DEDUCTIONS: (Add Lines 18 through 28) ...............................................................................................29.

00

30. Taxable Income Before Net Operating Losses: (Line 17 less Line 29) ..................................................................30.

00

31. Net Operating Losses: (Adjust for Non-taxable Income) .......................................................................................31.

32. Net Taxable Income: (Line 30 less Line 31 or Schedule A C4 page 2) (If Amended Return Box Checked, Enter

00

Amended Net Taxable Income).............................................................................................................................. 32.

00

33. Tax from Table: (Instruction Booklet, pages 19 and 20) .........................................................................................33.

00

34. Business Incentive Credits: (Attach all original certifi cates and Schedule AR1100BIC) ........................................34.

00

35. Tax Liability: (If Amended Return Box Checked, Enter Amended Tax Liability) .....................................................35.

00

36. Estimated Tax Paid: (Including estimate carryforward from prior year) .................................................................36.

37. Payment with Extension Request: .........................................................................................................................37.

00

38. Amended Return Only: (Enter Net tax paid (or refunded) on previous returns(s) for this tax year) .......................38.

00

39. Overpayment: (Line 36 plus line 37 less line 35; plus or minus Line 38, if applicable) ..........................................39.

00

40. Amount Applied to 2015 Estimated Tax ......................................................................40.

00

41. Amount Applied to Check Off Contributions: (Attach AR1100CO)...............................41.

00

00

42. Amount to be Refunded: (Line 39 less Lines 40 and 41) ...................................................................................... 42.

00

43. Tax Due: (Line 35 less Line 36 and 37; plus or minus Line 38, if applicable) ........................................................43.

00

44. Interest on Tax Due: ...............................................................................................................................................44.

00

45. Penalty for Late Filing or Payment: (See Instructions page 7) ...............................................................................45.

00

46. Penalty for Underpayment of Estimated Tax: (Attach AR2220) Enter exception checked in Part 3 ......................46.

00

47. Amount Due: (Add Lines 43 through 46) ...............................................................................................................47.

AR1100CT (R 8/2014)

PLEASE DO NOT STAPLE RETURNS, SCHEDULES OR ATTACHMENTS

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2