Form Ut-1a - Aircraft Use Tax Return Form - State Of Minnesota

ADVERTISEMENT

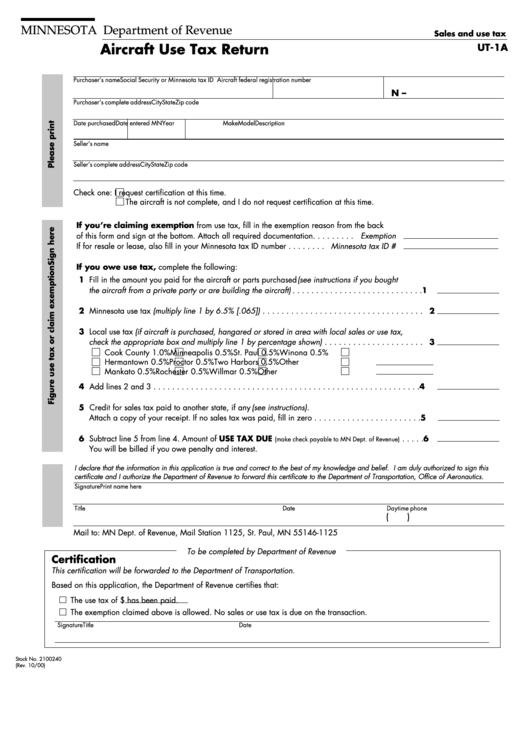

MINNESOTA Department of Revenue

Sales and use tax

Aircraft Use Tax Return

UT-1A

Purchaser’s name

Social Security or Minnesota tax ID

Aircraft federal registration number

N –

Purchaser’s complete address

City

State

Zip code

Date purchased

Date entered MN

Year

Make

Model

Description

Seller’s name

Seller’s complete address

City

State

Zip code

Check one:

I request certification at this time.

The aircraft is not complete, and I do not request certification at this time.

If you’re claiming exemption from use tax, fill in the exemption reason from the back

of this form and sign at the bottom. Attach all required documentation. . . . . . . . . Exemption

If for resale or lease, also fill in your Minnesota tax ID number . . . . . . . . Minnesota tax ID #

If you owe use tax, complete the following:

1 Fill in the amount you paid for the aircraft or parts purchased (see instructions if you bought

the aircraft from a private party or are building the aircraft) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Minnesota use tax (multiply line 1 by 6.5% [.065]) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Local use tax (if aircraft is purchased, hangared or stored in area with local sales or use tax,

check the appropriate box and multiply line 1 by percentage shown) . . . . . . . . . . . . . . . . . . . . . 3

Cook County 1.0%

Minneapolis 0.5%

St. Paul 0.5%

Winona 0.5%

Hermantown 0.5%

Proctor 0.5%

Two Harbors 0.5%

Other

Mankato 0.5%

Rochester 0.5%

Willmar 0.5%

Other

4 Add lines 2 and 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Credit for sales tax paid to another state, if any (see instructions).

Attach a copy of your receipt. If no sales tax was paid, fill in zero . . . . . . . . . . . . . . . . . . . . . . . 5

6 Subtract line 5 from line 4. Amount of USE TAX DUE

. . . . . 6

(make check payable to MN Dept. of Revenue)

You will be billed if you owe penalty and interest.

I declare that the information in this application is true and correct to the best of my knowledge and belief. I am duly authorized to sign this

certificate and I authorize the Department of Revenue to forward this certificate to the Department of Transportation, Office of Aeronautics.

Signature

Print name here

Title

Date

Daytime phone

(

)

Mail to: MN Dept. of Revenue, Mail Station 1125, St. Paul, MN 55146-1125

To be completed by Department of Revenue

Certification

This certification will be forwarded to the Department of Transportation.

Based on this application, the Department of Revenue certifies that:

The use tax of $

has been paid.

The exemption claimed above is allowed. No sales or use tax is due on the transaction.

Signature

Title

Date

Stock No. 2100240

(Rev. 10/00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1