Form Wv/sev-401 - West Virginia Annual Severance Tax Return - 2007

ADVERTISEMENT

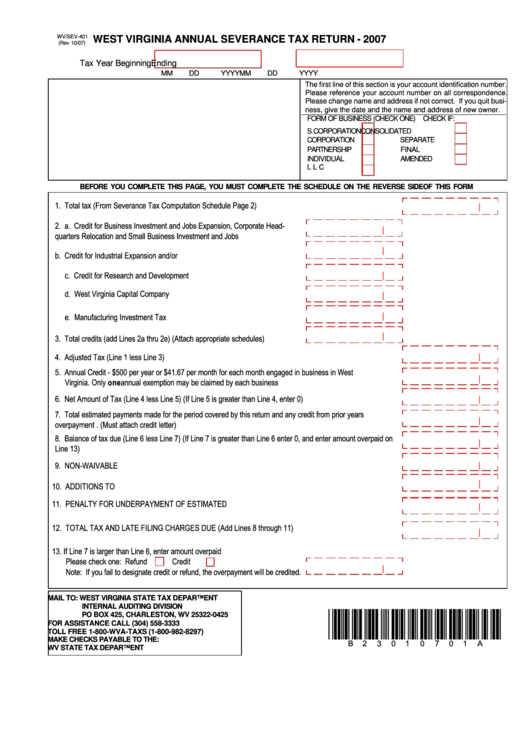

WV/SEV-401

WEST VIRGINIA ANNUAL SEVERANCE TAX RETURN - 2007

(Rev 10/07)

Tax Year Beginning

Ending

MM

DD

YYYY

MM

DD

YYYY

The first line of this section is your account identification number.

Please reference your account number on all correspondence.

Please change name and address if not correct. If you quit busi-

ness, give the date and the name and address of new owner.

FORM OF BUSINESS (CHECK ONE)

CHECK IF:

S CORPORATION

CONSOLIDATED

CORPORATION

SEPARATE

PARTNERSHIP

FINAL

INDIVIDUAL

AMENDED

L L C

BEFORE YOU COMPLETE THIS PAGE, YOU MUST COMPLETE THE SCHEDULE ON THE REVERSE SIDE OF THIS FORM

1. Total tax (From Severance Tax Computation Schedule Page 2)...........................................................

|

2. a. Credit for Business Investment and Jobs Expansion, Corporate Head-

|

quarters Relocation and Small Business Investment and Jobs Expansion...

|

b. Credit for Industrial Expansion and/or Revitalization...................................

c. Credit for Research and Development Projects.........................................

|

d. West Virginia Capital Company Credit.........................................................

|

e. Manufacturing Investment Tax Credit..........................................................

|

|

3. Total credits (add Lines 2a thru 2e) (Attach appropriate schedules)..................

4. Adjusted Tax (Line 1 less Line 3).....................................................................................................................

|

5. Annual Credit - $500 per year or $41.67 per month for each month engaged in business in West

|

Virginia. Only one annual exemption may be claimed by each business entity................................................

6. Net Amount of Tax (Line 4 less Line 5) (If Line 5 is greater than Line 4, enter 0).............................................

|

7. Total estimated payments made for the period covered by this return and any credit from prior years

|

overpayment . (Must attach credit letter).......................................................................................................

8. Balance of tax due (Line 6 less Line 7) (If Line 7 is greater than Line 6 enter 0, and enter amount overpaid on

|

Line 13)........................................................................................................................................................

9. NON-WAIVABLE INTEREST........................................................................................................................

|

|

10. ADDITIONS TO TAX...................................................................................................................................

11. PENALTY FOR UNDERPAYMENT OF ESTIMATED TAX..........................................................................

|

12. TOTAL TAX AND LATE FILING CHARGES DUE (Add Lines 8 through 11)..............................................

|

13. If Line 7 is larger than Line 6, enter amount overpaid

Please check one: Refund

Credit

|

Note: If you fail to designate credit or refund, the overpayment will be credited.

MAIL TO: WEST VIRGINIA STATE TAX DEPARTMENT

INTERNAL AUDITING DIVISION

*B23010701A*

PO BOX 425, CHARLESTON, WV 25322-0425

FOR ASSISTANCE CALL (304) 558-3333

TOLL FREE 1-800-WVA-TAXS (1-800-982-8297)

MAKE CHECKS PAYABLE TO THE:

WV STATE TAX DEPARTMENT

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2