9.6

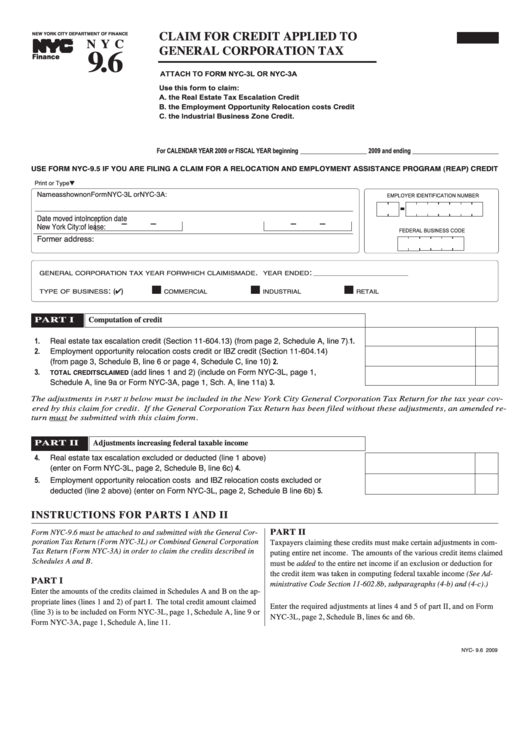

CLAIM FOR CREDIT APPLIED TO

N Y C

2009

GENERAL CORPORATION TAX

NEW YORK CITY DEPARTMENT OF FINANCE

TM

Finance

ATTACH TO FORM NYC-3L OR NYC-3A

Use this form to claim:

A. the Real Estate Tax Escalation Credit

B. the Employment Opportunity Relocation costs Credit

C. the Industrial Business Zone Credit.

For CALENDAR YEAR 2009 or FISCAL YEAR beginning ____________________ 2009 and ending __________________________

USE FORM NYC-9.5 IF YOU ARE FILING A CLAIM FOR A RELOCATION AND EMPLOYMENT ASSISTANCE PROGRAM (REAP) CREDIT

Print or Type M

Name as shown on Form NYC-3L or NYC-3A:

EMPLOYER IDENTIFICATION NUMBER

Date moved into

-

-

Inception date

-

-

New York City:

of lease:

Former address:

FEDERAL BUSINESS CODE

.

:

GENERAL CORPORATION TAX YEAR FOR WHICH CLAIM IS MADE

YEAR ENDED

___________________________

:

I I

I I

I I

TYPE OF BUSINESS

COMMERCIAL

INDUSTRIAL

RETAIL

(�)

PART I

Computation of credit

Real estate tax escalation credit (Section 11-604.13) (from page 2, Schedule A, line 7)

1.

1.

.......

Employment opportunity relocation costs credit or IBZ credit (Section 11-604.14)

2.

(from page 3, Schedule B, line 6 or page 4, Schedule C, line 10)

2.

......................................................

(add lines 1 and 2) (include on Form NYC-3L, page 1,

TOTAL CREDITS CLAIMED

3.

Schedule A, line 9a or Form NYC-3A, page 1, Sch. A, line 11a)

3.

..........................................................

The adjustments in

below must be included in the New York City General Corporation Tax Return for the tax year cov-

PART II

ered by this claim for credit. If the General Corporation Tax Return has been filed without these adjustments, an amended re-

turn must be submitted with this claim form.

PART II

Adjustments increasing federal taxable income

Real estate tax escalation excluded or deducted (line 1 above)

4.

(enter on Form NYC-3L, page 2, Schedule B, line 6c)

4.

...................................................................................

Employment opportunity relocation costs and IBZ relocation costs excluded or

5.

deducted (line 2 above) (enter on Form NYC-3L, page 2, Schedule B line 6b)

5.

..........................

INSTRUCTIONS FOR PARTS I AND II

PART II

Form NYC-9.6 must be attached to and submitted with the General Cor-

poration Tax Return (Form NYC-3L) or Combined General Corporation

Taxpayers claiming these credits must make certain adjustments in com-

Tax Return (Form NYC-3A) in order to claim the credits described in

puting entire net income. The amounts of the various credit items claimed

Schedules A and B.

must be added to the entire net income if an exclusion or deduction for

the credit item was taken in computing federal taxable income (See Ad-

PART I

ministrative Code Section 11-602.8b, subparagraphs (4-b) and (4-c).)

Enter the amounts of the credits claimed in Schedules A and B on the ap-

propriate lines (lines 1 and 2) of part I. The total credit amount claimed

Enter the required adjustments at lines 4 and 5 of part II, and on Form

(line 3) is to be included on Form NYC-3L, page 1, Schedule A, line 9 or

NYC-3L, page 2, Schedule B, lines 6c and 6b.

Form NYC-3A, page 1, Schedule A, line 11.

NYC- 9.6 2009

1

1 2

2 3

3 4

4