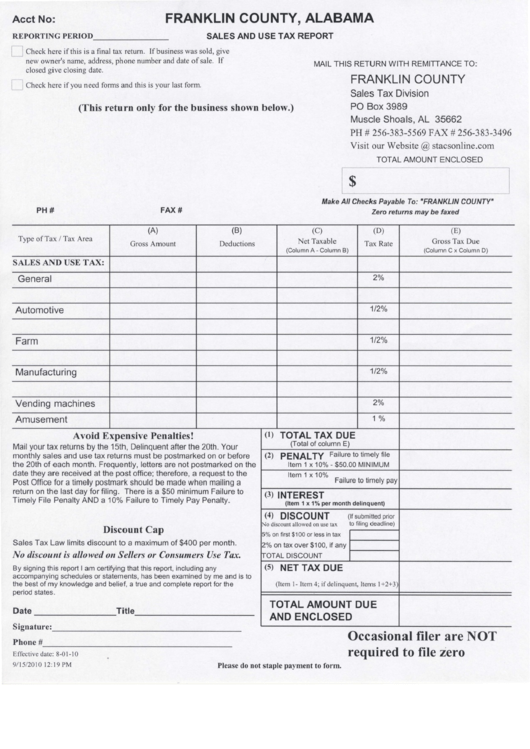

Sales And Use Tax Report Form - Franklin County, Alabama

ADVERTISEMENT

Acct No:

REPORTING PERIOD

] I Check here if this is a final tax retum. If business was sold, give

new owner's name, address, phone number and date of sale. If

closed give closing date.

I

Cnect here if you need forms and this is your last form.

(This return only for the business shown below.)

P H #

FAX #

FRANKLIN COUNTY, ALABAMA

SALES AND USE TA)( REPORT

MAIL THIS RETURN WITH REMITTANCE TO:

FRANKLIN COUNTY

Sales Tax Division

PO Box 3989

Muscle Shoals, AL 35662

pH# 2s6-383-ss69 FAX # 2s6-383-3496

Visit our Website @

TOTAL AMOUNT ENCLOSED

$

Make All Checks Payable To: 'FRANKLIN COUNTY'

Zero returns may be faxed

Type of Tax / Tax Area

SALES AND USE TAX:

General

Automotive

Farm

Manufacturing

Vending machines

Amusement

Avoid Expensive Penalties !

Mail your tax returns by the 15th, Delinquent after the 20th. Your

monthly sales and use tax returns must be postmarked on or before

the 20th of each month. Frequently, letters are not postmarked on the

date they are received at the post office; therefore, a request to the

Post Office for a timely postmark should be made when mailing a

return on the last day for filing. There is a $50 minimum Failure to

Timely File Penalty AND a 10% Failure to Timely Pay Penalty.

Discount Cap

Sales Tax Law limits discount to a maximum of $400 per month.

No discount is ullowed on Sellers or Consumers Use Tax.

By signing this report I am certifying that this report, including any

accompanying schedules or statements, has been examined by me and is to

the best of my knowledge and belief, a true and complete report for the

oeriod states.

Date

Signature:

Phone #

E f f e c t i v e d a t e : 8 - 0 1 - 1 0

9 / 1 5 / 2 0 1 0 l 2 : 1 9 P M

(E)

Gross Tax Due

( C o l u m n C x C o l u m n D )

Occasional filer are NOT

required to file zero

Title

(c)

Net Taxable

( C o l u m n A - C o l u m n B )

(I) TOTAL TAX DUE

(Total of column E)

(2) PENALTY

Failure to timelY file

I t e m 1 x 1 0 % - $ 5 0 . 0 0 M I N I M U M

Item 1 x 10%

Failure to timely pay

(3) INTEREST

(ltem I x 1% per month delinquent)

(4) DISCOUNT

(tf submitted

prior

discomt allowed on use tax

to filing deadline)

on first $100 or less in tax

on tax over $100, if any

(5) NET TAX DUE

(ltem I - Item 4; if delinquent, Items 1+2+3

TOTAL AMOUNT DUE

AND ENCLOSED

Please do not staple payment to form.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1