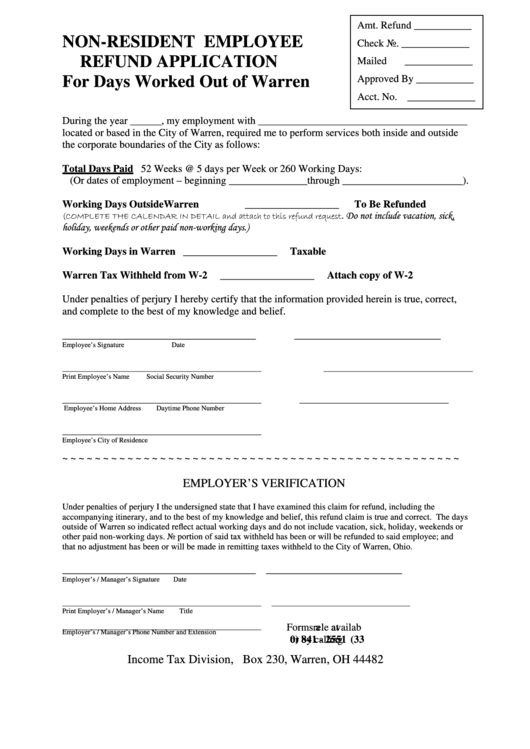

Non-Resident Employee Refund Application Form

ADVERTISEMENT

Amt. Refund ___________

NON-RESIDENT EMPLOYEE

Check No. _____________

REFUND APPLICATION

Mailed

_____________

For Days Worked Out of Warren

Approved By ___________

Acct. No. _____________

During the year ______, my employment with ________________________________________

located or based in the City of Warren, required me to perform services both inside and outside

the corporate boundaries of the City as follows:

Total Days Paid 52 Weeks @ 5 days per Week or 260 Working Days:

(Or dates of employment – beginning _______________through _______________________).

Working Days Outside Warren

__________________

To Be Refunded

. Do not include vacation, sick,

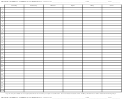

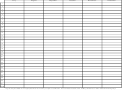

(COMPLETE THE CALENDAR IN DETAIL and attach to this refund request

holiday, weekends or other paid non-working days.)

Working Days in Warren

__________________

Taxable

Warren Tax Withheld from W-2

__________________

Attach copy of W-2

Under penalties of perjury I hereby certify that the information provided herein is true, correct,

and complete to the best of my knowledge and belief.

_____________________________________

____________________________

Employee’s Signature

Date

________________________________________________________

__________________________________________

Print Employee’s Name

Social Security Number

________________________________________________________

__________________________________________

Employee’s Home Address

Daytime Phone Number

________________________________________________________

Employee’s City of Residence

~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~

EMPLOYER’S VERIFICATION

Under penalties of perjury I the undersigned state that I have examined this claim for refund, including the

accompanying itinerary, and to the best of my knowledge and belief, this refund claim is true and correct. The days

outside of Warren so indicated reflect actual working days and do not include vacation, sick, holiday, weekends or

other paid non-working days. No portion of said tax withheld has been or will be refunded to said employee; and

that no adjustment has been or will be made in remitting taxes withheld to the City of Warren, Ohio.

_____________________________________

__________________________

Employer’s / Manager’s Signature

Date

________________________________________________________

_______________________________________

Print Employer’s / Manager’s Name

Title

Forms re

a

availab

le at

________________________________________________________

Employer’s / Manager’s Phone Number and Extension

or by calling (33

0) 841 - 2551

Income Tax Division, P.O. Box 230, Warren, OH 44482

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3