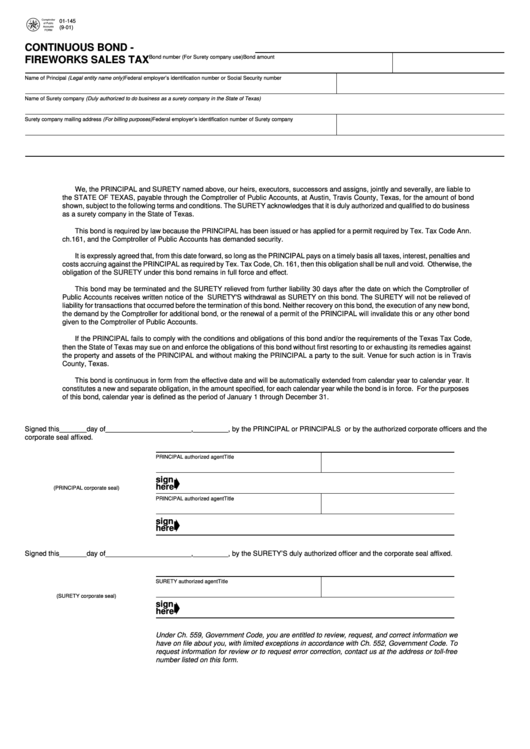

01-145

(9-01)

CONTINUOUS BOND -

Bond number (For Surety company use)

Bond amount

FIREWORKS SALES TAX

Name of Principal (Legal entity name only)

Federal employer’s identification number or Social Security number

Name of Surety company (Duly authorized to do business as a surety company in the State of Texas)

Surety company mailing address (For billing purposes)

Federal employer’s identification number of Surety company

We, the PRINCIPAL and SURETY named above, our heirs, executors, successors and assigns, jointly and severally, are liable to

the STATE OF TEXAS, payable through the Comptroller of Public Accounts, at Austin, Travis County, Texas, for the amount of bond

shown, subject to the following terms and conditions. The SURETY acknowledges that it is duly authorized and qualified to do business

as a surety company in the State of Texas.

This bond is required by law because the PRINCIPAL has been issued or has applied for a permit required by Tex. Tax Code Ann.

ch.161, and the Comptroller of Public Accounts has demanded security.

It is expressly agreed that, from this date forward, so long as the PRINCIPAL pays on a timely basis all taxes, interest, penalties and

costs accruing against the PRINCIPAL as required by Tex. Tax Code, Ch. 161, then this obligation shall be null and void. Otherwise, the

obligation of the SURETY under this bond remains in full force and effect.

This bond may be terminated and the SURETY relieved from further liability 30 days after the date on which the Comptroller of

Public Accounts receives written notice of the SURETY'S withdrawal as SURETY on this bond. The SURETY will not be relieved of

liability for transactions that occurred before the termination of this bond. Neither recovery on this bond, the execution of any new bond,

the demand by the Comptroller for additional bond, or the renewal of a permit of the PRINCIPAL will invalidate this or any other bond

given to the Comptroller of Public Accounts.

If the PRINCIPAL fails to comply with the conditions and obligations of this bond and/or the requirements of the Texas Tax Code,

then the State of Texas may sue on and enforce the obligations of this bond without first resorting to or exhausting its remedies against

the property and assets of the PRINCIPAL and without making the PRINCIPAL a party to the suit. Venue for such action is in Travis

County, Texas.

This bond is continuous in form from the effective date and will be automatically extended from calendar year to calendar year. It

constitutes a new and separate obligation, in the amount specified, for each calendar year while the bond is in force. For the purposes

of this bond, calendar year is defined as the period of January 1 through December 31.

Signed this _______ day of ______________________ , _________ , by the PRINCIPAL or PRINCIPALS or by the authorized corporate officers and the

corporate seal affixed.

PRINCIPAL authorized agent

Title

sign

here

(PRINCIPAL corporate seal)

PRINCIPAL authorized agent

Title

sign

here

Signed this _______ day of ______________________ , _________ , by the SURETY’S duly authorized officer and the corporate seal affixed.

SURETY authorized agent

Title

(SURETY corporate seal)

sign

here

Under Ch. 559, Government Code, you are entitled to review, request, and correct information we

have on file about you, with limited exceptions in accordance with Ch. 552, Government Code. To

request information for review or to request error correction, contact us at the address or toll-free

number listed on this form.

1

1