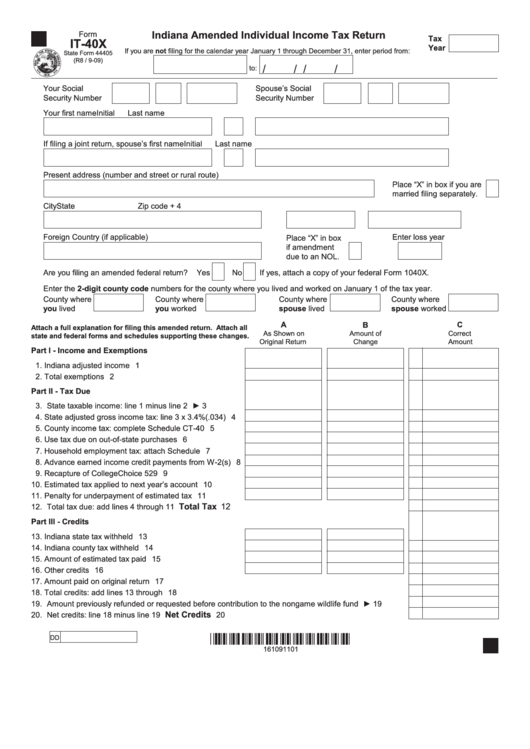

Indiana Amended Individual Income Tax Return

Form

Tax

IT-40X

Year

If you are not filing for the calendar year January 1 through December 31, enter period from:

State Form 44405

(R8 / 9-09)

/

/

/

/

to:

Your Social

Spouse’s Social

Security Number

Security Number

Your first name

Initial

Last name

If filing a joint return, spouse’s first name

Initial

Last name

Present address (number and street or rural route)

Place “X” in box if you are

married filing separately.

City

State

Zip code + 4

Foreign Country (if applicable)

Enter loss year

Place “X” in box

if amendment

due to an NOL.

Are you filing an amended federal return? Yes No

If yes, attach a copy of your federal Form 1040X.

Enter the 2-digit county code numbers for the county where you lived and worked on January 1 of the tax year.

County where

County where

County where

County where

you lived

you worked

spouse lived

spouse worked

A

B

C

Attach a full explanation for filing this amended return. Attach all

As Shown on

Amount of

Correct

state and federal forms and schedules supporting these changes.

Original Return

Change

Amount

Part I - Income and Exemptions

1. Indiana adjusted income ..................................................

1

2. Total exemptions ..............................................................

2

Part II - Tax Due

3. State taxable income: line 1 minus line 2 ......................►

3

4. State adjusted gross income tax: line 3 x 3.4%(.034) ......

4

5. County income tax: complete Schedule CT-40 ................

5

6. Use tax due on out-of-state purchases ............................

6

7. Household employment tax: attach Schedule IN-H..........

7

8. Advance earned income credit payments from W-2(s) ....

8

9. Recapture of CollegeChoice 529 credit............................

9

10. Estimated tax applied to next year’s account . ..................

10

11. Penalty for underpayment of estimated tax . .....................

11

................................................................................. Total Tax 12

12. Total tax due: add lines 4 through 11

Part III - Credits

13. Indiana state tax withheld . ................................................

13

14. Indiana county tax withheld ..............................................

14

15. Amount of estimated tax paid . ..........................................

15

16. Other credits . ....................................................................

16

17. Amount paid on original return ..................................................................................................................... 17

18. Total credits: add lines 13 through 17........................................................................................................... 18

19. Amount previously refunded or requested before contribution to the nongame wildlife fund . ...................► 19

Net Credits

20. Net credits: line 18 minus line 19 ............................................................................................

20

*161091101*

DD

161091101

1

1 2

2