Press Here To Print This Form

Save Form

Reset Form

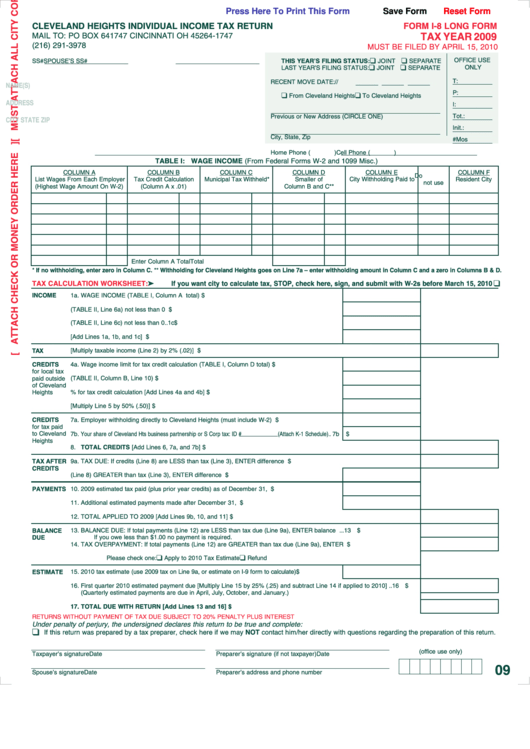

CLEVELAND HEIGHTS INDIVIDUAL INCOME TAX RETURN

FORM I-8 LONG FORM

TAX YEAR 2009

MAIL TO: PO BOX 641747 CINCINNATI OH 45264-1747

(216) 291-3978

MUST BE FILED BY APRIL 15, 2010

❑

❑

OFFICE USE

SS#

SPOUSE’S SS#

THIS YEARʼS FILING STATUS:

JOINT

SEPARATE

❑

❑

ONLY

LAST YEAR’S FILING STATUS:

JOINT

SEPARATE

T:

RECENT MOVE DATE:

/

/

NAME(S)

❑

❑

P:

From Cleveland Heights

To Cleveland Heights

ADDRESS

I:

Previous or New Address (CIRCLE ONE)

Tot.:

CITY STATE ZIP

Init.:

City, State, Zip

#Mos

Cell Phone (

)

Home Phone (

)

TABLE I: WAGE INCOME (From Federal Forms W-2 and 1099 Misc.)

COLUMN A

COLUMN B

COLUMN C

COLUMN D

COLUMN E

COLUMN F

Do

List Wages From Each Employer

Tax Credit Calculation

Municipal Tax Withheld*

Smaller of

City Withholding Paid to

Resident City

not use

(Highest Wage Amount On W-2)

(Column A x .01)

Column B and C**

Enter Column A Total

Total

* If no withholding, enter zero in Column C. ** Withholding for Cleveland Heights goes on Line 7a – enter withholding amount in Column C and a zero in Columns B & D.

❑

➤ If you want city to calculate tax, STOP, check here, sign, and submit with W-2s before March 15, 2010

TAX CALCULATION WORKSHEET:

INCOME

1a. WAGE INCOME (TABLE I, Column A total) ..............................................................................1a

$

1b. NON-WAGE INCOME earned in Cleveland Heights (TABLE II, Line 6a) not less than 0 ..........1b

$

1c. NON-WAGE INCOME earned outside Cleveland Heights (TABLE II, Line 6c) not less than 0 ..1c

$

2. TOTAL TAXABLE INCOME [Add Lines 1a, 1b, and 1c] ................................................................2

$

TAX

3. TAX [Multiply taxable income (Line 2) by 2% (.02)] ....................................................................................................................3 $

CREDITS

4a. Wage income limit for tax credit calculation (TABLE I, Column D total)......................................4a

$

for local tax

paid outside

4b. Non-wage income limit for tax credit calculation (TABLE II, Column B, Line 10)........................4b

$

of Cleveland

Heights

5. Total income limit of 1% for tax credit calculation [Add Lines 4a and 4b] ....................................5

$

6. TAX CREDIT [Multiply Line 5 by 50% (.50)] ..................................................................................6

$

7a. Employer withholding directly to Cleveland Heights (must include W-2) ....................................7a

$

CREDITS

for tax paid

to Cleveland

7b. Your share of Cleveland Hts business partnership or S Corp tax: ID #

(Attach K-1 Schedule)..7b

$

Heights

8. TOTAL CREDITS [Add Lines 6, 7a, and 7b] ..............................................................................................................................8 $

TAX AFTER

9a. TAX DUE: If credits (Line 8) are LESS than tax (Line 3), ENTER difference here ..................................................................9a $

CREDITS

9b. If credits (Line 8) GREATER than tax (Line 3), ENTER difference here ....................................9b

$

10. 2009 estimated tax paid (plus prior year credits) as of December 31, 2009 ..............................10

$

PAYMENTS

11. Additional estimated payments made after December 31, 2009 ................................................11

$

12. TOTAL APPLIED TO 2009 [Add Lines 9b, 10, and 11] ............................................................................................................12 $

BALANCE

13. BALANCE DUE: If total payments (Line 12) are LESS than tax due (Line 9a), ENTER balance due ....................................13 $

If you owe less than $1.00 no payment is required.

DUE

14. TAX OVERPAYMENT: If total payments (Line 12) are GREATER than tax due (Line 9a), ENTER overpayment ....................14 $

❑

❑

Please check one:

Apply to 2010 Tax Estimate

Refund

15. 2010 tax estimate (use 2009 tax on Line 9a, or estimate on I-9 form to calculate) ......................15

$

ESTIMATE

16. First quarter 2010 estimated payment due [Multiply Line 15 by 25% (.25) and subtract Line 14 if applied to 2010] ..............16 $

(Quarterly estimated payments are due in April, July, October, and January.)

17. TOTAL DUE WITH RETURN [Add Lines 13 and 16]..............................................................................................................17 $

RETURNS WITHOUT PAYMENT OF TAX DUE SUBJECT TO 20% PENALTY PLUS INTEREST

Under penalty of perjury, the undersigned declares this return to be true and complete:

❑

If this return was prepared by a tax preparer, check here if we may NOT contact him/her directly with questions regarding the preparation of this return.

(office use only)

Taxpayer’s signature

Date

Preparer’s signature (if not taxpayer)

Date

09

Spouse’s signature

Date

Preparer’s address and phone number

1

1 2

2