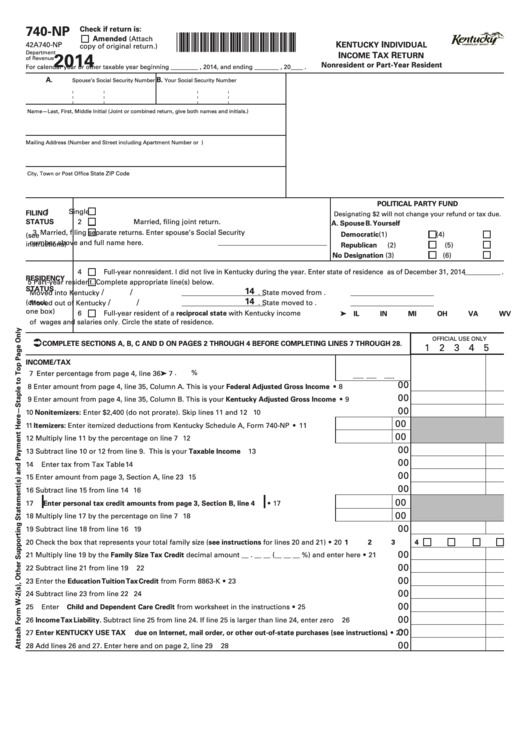

740-NP

Check if return is:

*1400030004*

Amended

(Attach

K

I

42A740-NP

ENTUCKY

NDIVIDUAL

copy of original return.)

Department

I

T

R

2014

NCOME

AX

ETURN

of Revenue

Nonresident or Part-Year Resident

For calendar year or other taxable year beginning _________ , 2014, and ending ________ , 20____ .

A.

B.

Spouse’s Social Security Number

Your Social Security Number

Name—Last, First, Middle Initial (Joint or combined return, give both names and initials.)

Mailing Address (Number and Street including Apartment Number or P .O. Box)

City, Town or Post Office

State

ZIP Code

POLITICAL PARTY FUND

1

Single

FILING

Designating $2 will not change your refund or tax due.

STATUS

2

Married, filing joint return.

A. Spouse

B. Yourself

3

Married, filing separate returns. Enter spouse’s Social Security

Democratic

(1)

(4)

(see

number above and full name here.

instructions)

(2)

(5)

Republican

No Designation

(3)

(6)

4

Full-year nonresident. I did not live in Kentucky during the year. Enter state of residence as of December 31, 2014

.

RESIDENCY

5

Part-year resident. Complete appropriate line(s) below.

STATUS

/ 14

/

Moved into Kentucky

.

State moved from

.

/ 14

/

(check

Moved out of Kentucky

.

State moved to

.

one box)

6

Full-year resident of a reciprocal state with Kentucky income

IL

IN

MI

OH

VA

WV

WI

➤

of wages and salaries only. Circle the state of residence.

OFFICIAL USE ONLY

COMPLETE SECTIONS A, B, C AND D ON PAGES 2 THROUGH 4 BEFORE COMPLETING LINES 7 THROUGH 28.

1 2 3 4 5

INCOME/TAX

.

%

7

Enter percentage from page 4, line 36 ..............................................................................➤ 7

00

8

Enter amount from page 4, line 35, Column A. This is your Federal Adjusted Gross Income ........................... • 8

00

9

Enter amount from page 4, line 35, Column B. This is your Kentucky Adjusted Gross Income ....................... • 9

00

10

Nonitemizers: Enter $2,400 (do not prorate). Skip lines 11 and 12 .....................................................................

10

00

11

Itemizers: Enter itemized deductions from Kentucky Schedule A, Form 740-NP ......... • 11

00

12

Multiply line 11 by the percentage on line 7 ....................................................................

12

00

13

Subtract line 10 or 12 from line 9. This is your Taxable Income ..........................................................................

13

00

14

Enter tax from Tax Table ...........................................................................................................................................

14

00

15

Enter amount from page 3, Section A, line 23 .......................................................................................................

15

00

16

Subtract line 15 from line 14 ....................................................................................................................................

16

00

17

Enter personal tax credit amounts from page 3, Section B, line 4

...................... • 17

00

18

Multiply line 17 by the percentage on line 7 ...................................................................

18

00

19

Subtract line 18 from line 16 ....................................................................................................................................

19

20

Check the box that represents your total family size (see instructions for lines 20 and 21) .............................. • 20

1

2

3

4

00

21

Multiply line 19 by the Family Size Tax Credit decimal amount __ . __ __ (__ __ __ %) and enter here .............. • 21

00

22

Subtract line 21 from line 19 ....................................................................................................................................

22

00

23

Enter the Education Tuition Tax Credit from Form 8863-K ..................................................................................... • 23

00

24

Subtract line 23 from line 22 ...................................................................................................................................

24

00

25

Enter Child and Dependent Care Credit from worksheet in the instructions ...................................................... • 25

00

26

Income Tax Liability. Subtract line 25 from line 24. If line 25 is larger than line 24, enter zero ..........................

26

00

27

Enter KENTUCKY USE TAX due on Internet, mail order, or other out-of-state purchases (see instructions) .. • 27

00

28

Add lines 26 and 27. Enter here and on page 2, line 29 .........................................................................................

28

1

1 2

2 3

3 4

4