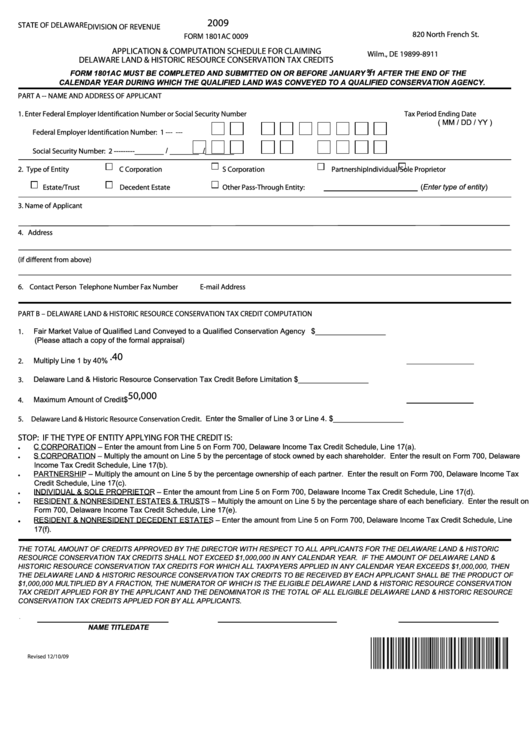

Form 1801ac 0009 - Application & Computation Schedule For Claiming Delaware Land & Historic Resource Conservation Tax Credits - 2009

ADVERTISEMENT

2009

STATE OF DELAWARE

DIVISION OF REVENUE

820 North French St.

FORM 1801AC 0009

P.O. Box 8911

APPLICATION & COMPUTATION SCHEDULE FOR CLAIMING

Wilm., DE 19899-8911

DELAWARE LAND & HISTORIC RESOURCE CONSERVATION TAX CREDITS

ST

FORM 1801AC MUST BE COMPLETED AND SUBMITTED ON OR BEFORE JANUARY 31 AFTER THE END OF THE

CALENDAR YEAR DURING WHICH THE QUALIFIED LAND WAS CONVEYED TO A QUALIFIED CONSERVATION AGENCY.

PART A -- NAME AND ADDRESS OF APPLICANT

1. Enter Federal Employer Identi cation Number or Social Security Number

Tax Period Ending Date

( MM / DD / YY )

Federal Employer Identi cation Number:

1 ---

---

_______ / _______ /_______

Social Security Number:

2 ---

---

---

2. Type of Entity

C Corporation

S Corporation

Partnership

Individual/Sole Proprietor

(Enter type of entity)

Estate/Trust

Decedent Estate

Other Pass-Through Entity:

3. Name of Applicant

4. Address

5. Delaware Address (if di erent from above)

6. Contact Person

Telephone Number

Fax Number

E-mail Address

PART B – DELAWARE LAND & HISTORIC RESOURCE CONSERVATION TAX CREDIT COMPUTATION

Fair Market Value of Qualified Land Conveyed to a Qualified Conservation Agency

$

_________________

1.

(Please attach a copy of the formal appraisal)

.40

Multiply Line 1 by 40%

2.

Delaware Land & Historic Resource Conservation Tax Credit Before Limitation

$

_________________

3.

50,000

Maximum Amount of Credit

$

4.

Enter the Smaller of Line 3 or Line 4.

$

_________________

5. Delaware Land & Historic Resource Conservation Credit.

STOP: IF THE TYPE OF ENTITY APPLYING FOR THE CREDIT IS:

C CORPORATION – Enter the amount from Line 5 on Form 700, Delaware Income Tax Credit Schedule, Line 17(a).

•

S CORPORATION – Multiply the amount on Line 5 by the percentage of stock owned by each shareholder. Enter the result on Form 700, Delaware

•

Income Tax Credit Schedule, Line 17(b).

PARTNERSHIP – Multiply the amount on Line 5 by the percentage ownership of each partner. Enter the result on Form 700, Delaware Income Tax

•

Credit Schedule, Line 17(c).

INDIVIDUAL & SOLE PROPRIETOR – Enter the amount from Line 5 on Form 700, Delaware Income Tax Credit Schedule, Line 17(d).

•

RESIDENT & NONRESIDENT ESTATES & TRUSTS – Multiply the amount on Line 5 by the percentage share of each beneficiary. Enter the result on

•

Form 700, Delaware Income Tax Credit Schedule, Line 17(e).

RESIDENT & NONRESIDENT DECEDENT ESTATES – Enter the amount from Line 5 on Form 700, Delaware Income Tax Credit Schedule, Line

•

17(f).

THE TOTAL AMOUNT OF CREDITS APPROVED BY THE DIRECTOR WITH RESPECT TO ALL APPLICANTS FOR THE DELAWARE LAND & HISTORIC

RESOURCE CONSERVATION TAX CREDITS SHALL NOT EXCEED $1,000,000 IN ANY CALENDAR YEAR. IF THE AMOUNT OF DELAWARE LAND &

HISTORIC RESOURCE CONSERVATION TAX CREDITS FOR WHICH ALL TAXPAYERS APPLIED IN ANY CALENDAR YEAR EXCEEDS $1,000,000, THEN

THE DELAWARE LAND & HISTORIC RESOURCE CONSERVATION TAX CREDITS TO BE RECEIVED BY EACH APPLICANT SHALL BE THE PRODUCT OF

$1,000,000 MULTIPLIED BY A FRACTION, THE NUMERATOR OF WHICH IS THE ELIGIBLE DELAWARE LAND & HISTORIC RESOURCE CONSERVATION

TAX CREDIT APPLIED FOR BY THE APPLICANT AND THE DENOMINATOR IS THE TOTAL OF ALL ELIGIBLE DELAWARE LAND & HISTORIC RESOURCE

CONSERVATION TAX CREDITS APPLIED FOR BY ALL APPLICANTS.

NAME

TITLE

DATE

Revised 12/10/09

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1