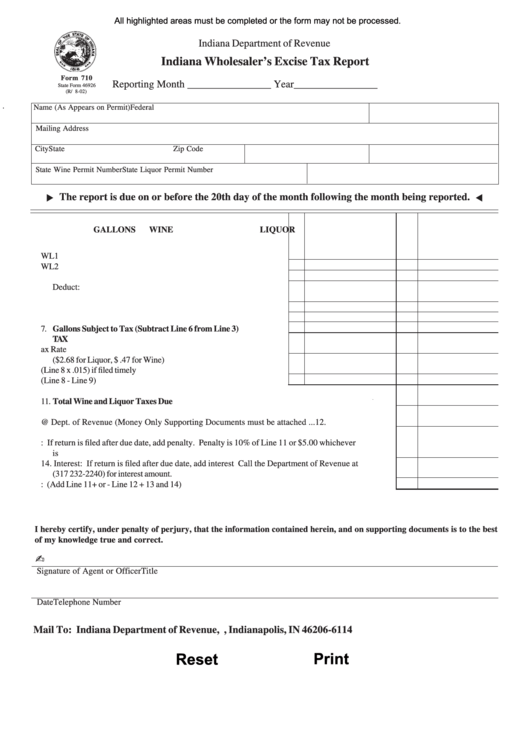

All highlighted areas must be completed or the form may not be processed.

Indiana Department of Revenue

Indiana Wholesaler’s Excise Tax Report

Form 710

Reporting Month ________________ Year________________

State Form 46926

(R/ 8-02)

Name (As Appears on Permit)

Federal I.D. Number

Mailing Address

City

State

Zip Code

State Wine Permit Number

State Liquor Permit Number

The report is due on or before the 20th day of the month following the month being reported.

GALLONS

WINE

LIQUOR

1. Gallons per Schedule WL1 ...............................................................

1.

1.

2. Gallons per Schedule WL2 ...............................................................

2.

2.

3. Subtotal Lines 1 and 2 ......................................................................

3.

3.

Deduct:

4. Schedule WL3 ..................................................................................

4.

4.

5. Schedule WL4 ..................................................................................

5.

5.

6. Subtotal Lines 4 and 5 ......................................................................

6.

6.

7. Gallons Subject to Tax (Subtract Line 6 from Line 3) ....................

7.

7.

TAX

8. Multiply Line 7 by Tax Rate .............................................................

8.

8.

($2.68 for Liquor, $ .47 for Wine)

9. Discount (Line 8 x .015) if filed timely ...............................................

9.

9.

10. Net Amount Due (Line 8 - Line 9) ....................................................

10.

10.

11. Total Wine and Liquor Taxes Due ......................................................................................................

11.

12. Adjustments Auth. @ Dept. of Revenue (Money Only Supporting Documents must be attached ...

12.

13. Penalty: If return is filed after due date, add penalty. Penalty is 10% of Line 11 or $5.00 whichever

is greater. .............................................................................................................................................

13.

14. Interest: If return is filed after due date, add interest Call the Department of Revenue at

(317 232-2240) for interest amount. ......................................................................................................

14.

15. TOTAL AMOUNT DUE: (Add Line 11 + or - Line 12 + 13 and 14) ....................................................

15.

I hereby certify, under penalty of perjury, that the information contained herein, and on supporting documents is to the best

of my knowledge true and correct.

Signature of Agent or Officer

Title

Date

Telephone Number

Mail To: Indiana Department of Revenue, P.O. Box 6114, Indianapolis, IN 46206-6114

Reset

Print

1

1