Important: Click this button to reset the form

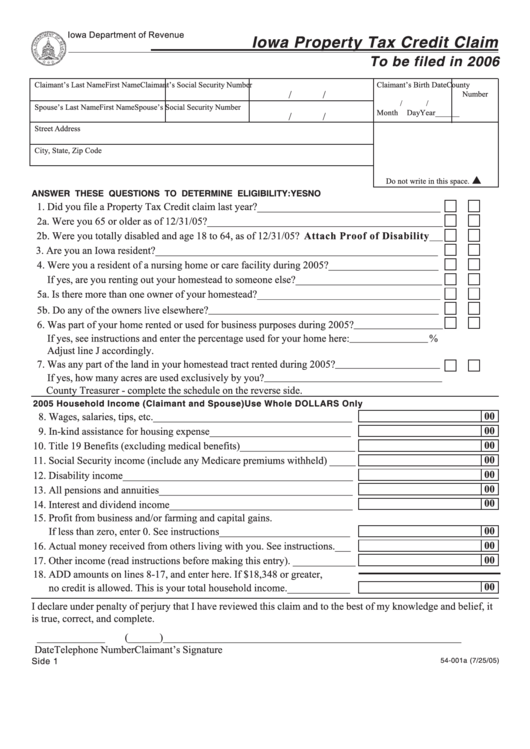

Iowa Department of Revenue

Iowa Property Tax Credit Claim

To be filed in 2006

Claimant’s Last Name

First Name

Claimant’s Social Security Number

Claimant’s Birth Date

County

/

/

Number

/

/

Spouse’s Last Name

First Name

Spouse’s Social Security Number

Month

Day

Year

___

___

/

/

Street Address

City, State, Zip Code

Do not write in this space.

ANSWER THESE QUESTIONS TO DETERMINE ELIGIBILITY:

YES NO

1. Did you file a Property Tax Credit claim last year? ___________________________________

2a. Were you 65 or older as of 12/31/05? _____________________________________________

2b. Were you totally disabled and age 18 to 64, as of 12/31/05? Attach Proof of Disability

___

3. Are you an Iowa resident? ______________________________________________________

4. Were you a resident of a nursing home or care facility during 2005? _____________________

If yes, are you renting out your homestead to someone else? ____________________________

5a. Is there more than one owner of your homestead? ___________________________________

5b. Do any of the owners live elsewhere? ____________________________________________

6. Was part of your home rented or used for business purposes during 2005? _________________

If yes, see instructions and enter the percentage used for your home here: _______________ %

Adjust line J accordingly.

7. Was any part of the land in your homestead tract rented during 2005? ____________________

If yes, how many acres are used exclusively by you? __________________________________

County Treasurer - complete the schedule on the reverse side.

2005 Household Income (Claimant and Spouse)

Use Whole DOLLARS Only

00

8. Wages, salaries, tips, etc. ______________________________________

00

9. In-kind assistance for housing expense ___________________________

00

10. Title 19 Benefits (excluding medical benefits) ______________________

00

11. Social Security income (include any Medicare premiums withheld) _____

00

12. Disability income ____________________________________________

00

13. All pensions and annuities _____________________________________

00

14. Interest and dividend income ___________________________________

15. Profit from business and/or farming and capital gains.

00

If less than zero, enter 0. See instructions _________________________

00

16. Actual money received from others living with you. See instructions. ___

00

17. Other income (read instructions before making this entry). ____________

18. ADD amounts on lines 8-17, and enter here. If $18,348 or greater,

00

no credit is allowed. This is your total household income. ____________

I declare under penalty of perjury that I have reviewed this claim and to the best of my knowledge and belief, it

is true, correct, and complete.

_____________

(______)______________

___________________________________________

Date

Telephone Number

Claimant’s Signature

Side 1

54-001a (7/25/05)

1

1 2

2