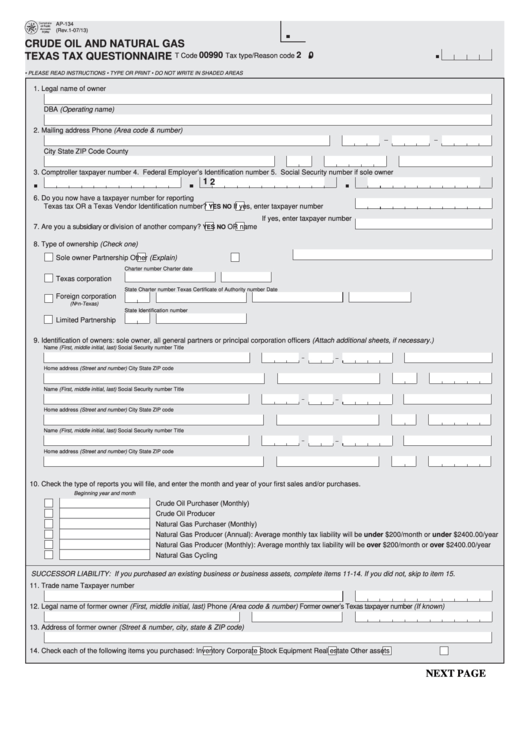

AP-134

(Rev.1-07/13)

CRUDE OIL AND NATURAL GAS

00990

2 0

TEXAS TAX QUESTIONNAIRE

T Code

Tax type/Reason code

• PLEASE READ INSTRUCTIONS

• TYPE OR PRINT

• DO NOT WRITE IN SHADED AREAS

1. Legal name of owner

DBA (Operating name)

2. Mailing address

Phone (Area code & number)

City

State

ZIP Code

County

3. Comptroller taxpayer number

4. Federal Employer’s Identification number

5. Social Security number if sole owner

1

2

6. Do you now have a taxpayer number for reporting

Texas tax OR a Texas Vendor Identification number?

If yes, enter taxpayer number

YES

NO

If yes, enter taxpayer number

7. Are you a subsidiary or division of another company?

OR name

YES

NO

8. Type of ownership (Check one)

Sole owner

Partnership

Other (Explain)

Charter number

Charter date

Texas corporation

State

Charter number

Texas Certificate of Authority number

Date

Foreign corporation

(Non-Texas)

State

Identification number

Limited Partnership

9. Identification of owners: sole owner, all general partners or principal corporation officers (Attach additional sheets, if necessary.)

Name (First, middle initial, last)

Social Security number

Title

Home address (Street and number)

City

State

ZIP code

Name (First, middle initial, last)

Social Security number

Title

Home address (Street and number)

City

State

ZIP code

Name (First, middle initial, last)

Social Security number

Title

Home address (Street and number)

City

State

ZIP code

10. Check the type of reports you will file, and enter the month and year of your first sales and/or purchases.

Beginning year and month

Crude Oil Purchaser (Monthly)

Crude Oil Producer

Natural Gas Purchaser (Monthly)

Natural Gas Producer (Annual): Average monthly tax liability will be under $200/month or under $2400.00/year

Natural Gas Producer (Monthly): Average monthly tax liability will be over $200/month or over $2400.00/year

Natural Gas Cycling

SUCCESSOR LIABILITY: If you purchased an existing business or business assets, complete items 11-14. If you did not, skip to item 15.

11. Trade name

Taxpayer number

12. Legal name of former owner (First, middle initial, last)

Phone (Area code & number)

Former owner’s Texas taxpayer number (If known)

13. Address of former owner (Street & number, city, state & ZIP code)

14. Check each of the following items you purchased:

Inventory

Corporate Stock

Equipment

Real estate

Other assets

NEXT PAGE

1

1 2

2