Compressed Natural Gas Vendor Tax Return Form - State Of South Dakota

ADVERTISEMENT

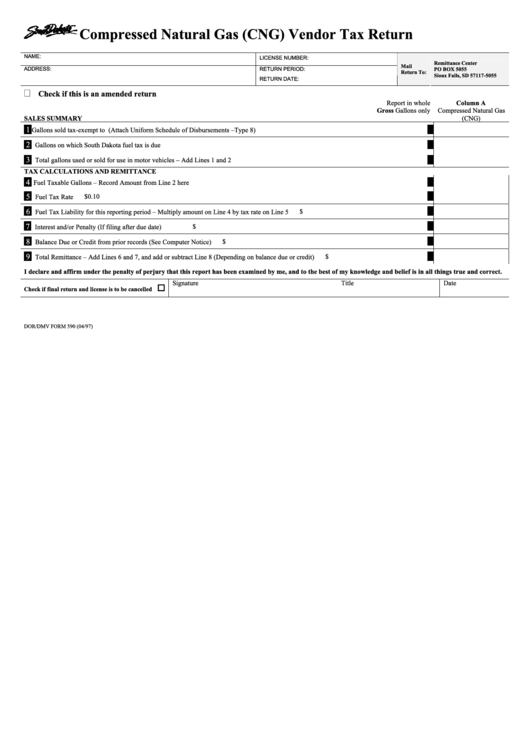

Compressed Natural Gas (CNG) Vendor Tax Return

NAME:

LICENSE NUMBER:

Remittance Center

Mail

ADDRESS:

RETURN PERIOD:

PO BOX 5055

Return To:

Sioux Falls, SD 57117-5055

RETURN DATE:

Check if this is an amended return

Report in whole

Column A

Gross Gallons only

Compressed Natural Gas

SALES SUMMARY

(CNG)

1

1

Gallons sold tax-exempt to U.S. government agencies for use in motor vehicles (Attach Uniform Schedule of Disbursements –Type 8)

2

2

Gallons on which South Dakota fuel tax is due

3

3

Total gallons used or sold for use in motor vehicles – Add Lines 1 and 2

TAX CALCULATIONS AND REMITTANCE

4

4

Fuel Taxable Gallons – Record Amount from Line 2 here

5

5

$0.10

Fuel Tax Rate

6

6

$

Fuel Tax Liability for this reporting period – Multiply amount on Line 4 by tax rate on Line 5

7

7

$

Interest and/or Penalty (If filing after due date)

8

8

$

Balance Due or Credit from prior records (See Computer Notice)

9

9

$

Total Remittance – Add Lines 6 and 7, and add or subtract Line 8 (Depending on balance due or credit)

I declare and affirm under the penalty of perjury that this report has been examined by me, and to the best of my knowledge and belief is in all things true and correct.

Signature

Title

Date

Check if final return and license is to be cancelled

DOR/DMV FORM 590 (04/97)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1