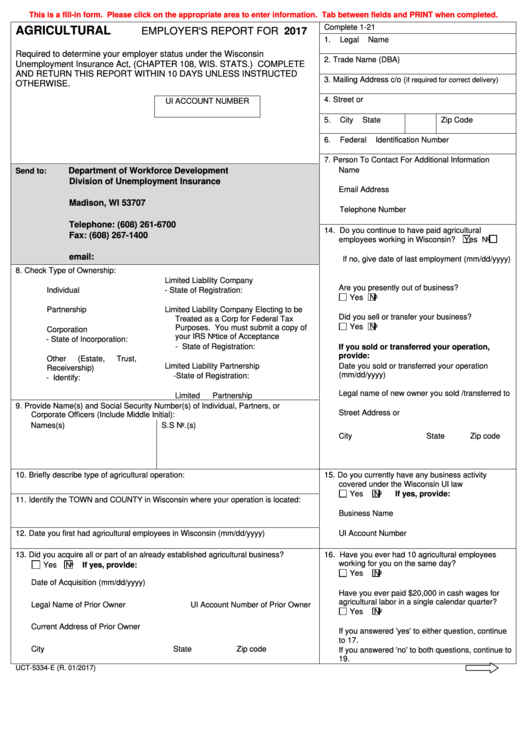

This is a fill-in form. Please click on the appropriate area to enter information. Tab between fields and PRINT when completed.

Complete 1-21

AGRICULTURAL

EMPLOYER'S REPORT FOR 2017

1.

Legal Name

Required to determine your employer status under the Wisconsin

2.

Trade Name (DBA)

Unemployment Insurance Act, (CHAPTER 108, WIS. STATS.) COMPLETE

AND RETURN THIS REPORT WITHIN 10 DAYS UNLESS INSTRUCTED

3.

Mailing Address c/o (

if required for correct delivery)

OTHERWISE.

4.

Street or P.O. Box

UI ACCOUNT NUMBER

5.

City

State

Zip Code

6.

Federal Identification Number

7.

Person To Contact For Additional Information

Name

Department of Workforce Development

Send to:

Division of Unemployment Insurance

Email Address

P.O. Box 7942

Madison, WI 53707

Telephone Number

Telephone: (608) 261-6700

14. Do you continue to have paid agricultural

Fax: (608) 267-1400

employees working in Wisconsin?

Yes

No

email: taxnet@dwd.wisconsin.gov

If no, give date of last employment (mm/dd/yyyy)

8.

Check Type of Ownership:

Limited Liability Company

Are you presently out of business?

Individual

- State of Registration:

Yes

No

Partnership

Limited Liability Company Electing to be

Did you sell or transfer your business?

Treated as a Corp for Federal Tax

Yes

No

Purposes. You must submit a copy of

Corporation

your IRS Notice of Acceptance

- State of Incorporation:

- State of Registration:

If you sold or transferred your operation,

provide:

Other (Estate, Trust,

Limited Liability Partnership

Date you sold or transferred your operation

Receivership)

(mm/dd/yyyy)

-State of Registration:

- Identify:

Legal name of new owner you sold /transferred to

Limited Partnership

9.

Provide Name(s) and Social Security Number(s) of Individual, Partners, or

Street Address or P.O. Box of new owner

Corporate Officers (Include Middle Initial):

Names(s)

S.S No.(s)

City

State

Zip code

10. Briefly describe type of agricultural operation:

15. Do you currently have any business activity

covered under the Wisconsin UI law

Yes

No

If yes, provide:

11. Identify the TOWN and COUNTY in Wisconsin where your operation is located:

Business Name

12. Date you first had agricultural employees in Wisconsin (mm/dd/yyyy)

UI Account Number

13. Did you acquire all or part of an already established agricultural business?

16. Have you ever had 10 agricultural employees

working for you on the same day?

Yes

No

If yes, provide:

Yes

No

Date of Acquisition (mm/dd/yyyy)

Have you ever paid $20,000 in cash wages for

agricultural labor in a single calendar quarter?

Legal Name of Prior Owner

UI Account Number of Prior Owner

Yes

No

Current Address of Prior Owner

If you answered 'yes' to either question, continue

to 17.

City

State

Zip code

If you answered 'no' to both questions, continue to

19.

UCT-5334-E (R. 01/2017)

1

1 2

2