Form 2374 - Michigan Tobacco Products Inventory Tax Return Form - Department Of Treasury, Michigan

ADVERTISEMENT

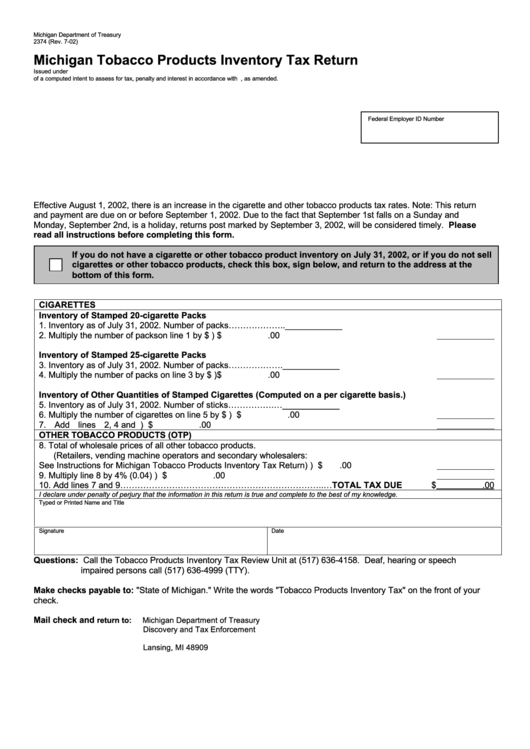

Michigan Department of Treasury

2374 (Rev. 7-02)

Michigan Tobacco Products Inventory Tax Return

Issued under P.A. 327 of 1993. Failure to file this return and/or remit the tax due may result in the issuance

of a computed intent to assess for tax, penalty and interest in accordance with P.A. 122 of 1941, as amended.

Federal Employer ID Number

Effective August 1, 2002, there is an increase in the cigarette and other tobacco products tax rates. Note: This return

and payment are due on or before September 1, 2002. Due to the fact that September 1st falls on a Sunday and

Monday, September 2nd, is a holiday, returns post marked by September 3, 2002, will be considered timely. Please

read all instructions before completing this form.

If you do not have a cigarette or other tobacco product inventory on July 31, 2002, or if you do not sell

cigarettes or other tobacco products, check this box, sign below, and return to the address at the

bottom of this form.

CIGARETTES

Inventory of Stamped 20-cigarette Packs

1. Inventory as of July 31, 2002. Number of packs………………..____________

2. Multiply the number of packs on line 1 by $.50 ...................................................................... Line 2) $

.00

Inventory of Stamped 25-cigarette Packs

3. Inventory as of July 31, 2002. Number of packs……………….____________

4. Multiply the number of packs on line 3 by $.625 .................................................................... Line 4) $

.00

Inventory of Other Quantities of Stamped Cigarettes (Computed on a per cigarette basis.)

5. Inventory as of July 31, 2002. Number of sticks…………….…____________

6. Multiply the number of cigarettes on line 5 by $.025.............................................................. Line 6) $

.00

7. Add lines 2, 4 and 6................................................................................................................ Line 7) $

.00

OTHER TOBACCO PRODUCTS (OTP)

8. Total of wholesale prices of all other tobacco products.

(Retailers, vending machine operators and secondary wholesalers:

See Instructions for Michigan Tobacco Products Inventory Tax Return) ............................... Line 8) $

.00

9. Multiply line 8 by 4% (0.04). ................................................................................................... Line 9) $

.00

10. Add lines 7 and 9……………………………………………………………..…TOTAL TAX DUE

$

.00

I declare under penalty of perjury that the information in this return is true and complete to the best of my knowledge.

Typed or Printed Name and Title

Signature

Date

Questions: Call the Tobacco Products Inventory Tax Review Unit at (517) 636-4158. Deaf, hearing or speech

impaired persons call (517) 636-4999 (TTY).

Make checks payable to: "State of Michigan." Write the words "Tobacco Products Inventory Tax" on the front of your

check.

Mail check and

return to:

Michigan Department of Treasury

Discovery and Tax Enforcement

P.O. Box 30140

Lansing, MI 48909

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1