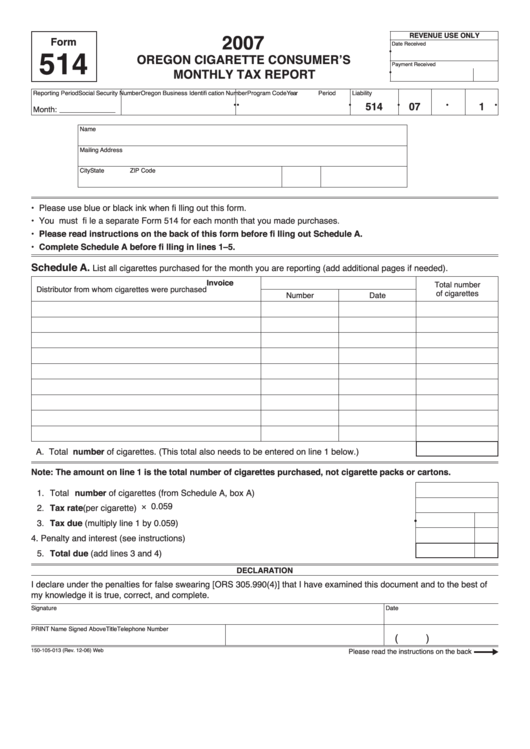

Clear Form

REVENUE USE ONLY

2007

Form

Date Received

•

514

OREGON CIGARETTE CONSUMER’S

Payment Received

•

MONTHLY TAX REPORT

Reporting Period

Social Security Number

Oregon Business Identifi cation Number

Program Code

Year

Period

Liability

•

•

•

•

•

•

514

07

1

Month:

Name

Mailing Address

City

State

ZIP Code

• Please use blue or black ink when fi lling out this form.

• You must fi le a separate Form 514 for each month that you made purchases.

• Please read instructions on the back of this form before fi lling out Schedule A.

• Complete Schedule A before fi lling in lines 1– 5.

Schedule A.

List all cigarettes purchased for the month you are reporting (add additional pages if needed).

Invoice

Total number

Distributor from whom cigarettes were purchased

of cigarettes

Number

Date

A. Total number of cigarettes. (This total also needs to be entered on line 1 below.) .............. Box A

Note: The amount on line 1 is the total number of cigarettes purchased, not cigarette packs or cartons.

1. Total number of cigarettes (from Schedule A, box A) .................................................................. 1

× 0.059

2. Tax rate (per cigarette) ................................................................................................................ 2

•

3. Tax due (multiply line 1 by 0.059) ................................................................................................ 3

4. Penalty and interest (see instructions) ......................................................................................... 4

5. Total due (add lines 3 and 4)....................................................................................................... 5

DECLARATION

I declare under the penalties for false swearing [ORS 305.990(4)] that I have examined this document and to the best of

my knowledge it is true, correct, and complete.

Signature

Date

PRINT Name Signed Above

Title

Telephone Number

(

)

150-105-013 (Rev. 12-06) Web

Please read the instructions on the back

1

1 2

2