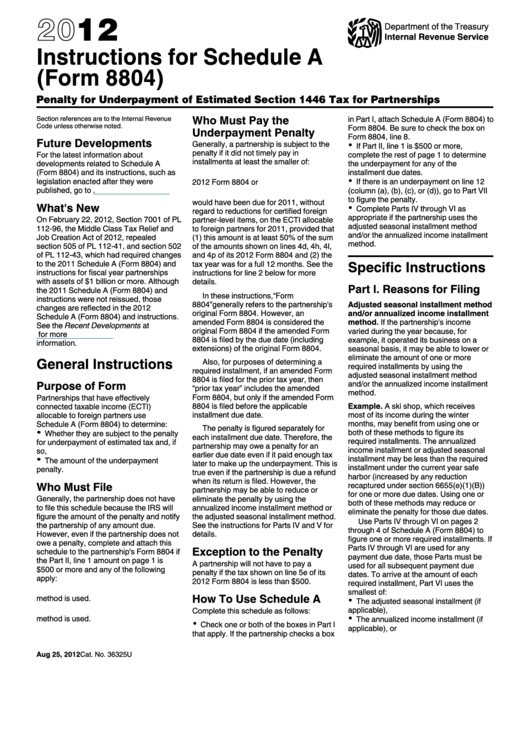

Instructions For Schedule A (Form 8804) - Penalty For Underpayment Of Estimated Section 1446 Tax For Partnerships - 2012

ADVERTISEMENT

2012

Department of the Treasury

Internal Revenue Service

Instructions for Schedule A

(Form 8804)

Penalty for Underpayment of Estimated Section 1446 Tax for Partnerships

Who Must Pay the

in Part I, attach Schedule A (Form 8804) to

Section references are to the Internal Revenue

Code unless otherwise noted.

Form 8804. Be sure to check the box on

Underpayment Penalty

Form 8804, line 8.

Future Developments

Generally, a partnership is subject to the

If Part II, line 1 is $500 or more,

penalty if it did not timely pay in

For the latest information about

complete the rest of page 1 to determine

installments at least the smaller of:

developments related to Schedule A

the underpayment for any of the

(Form 8804) and its instructions, such as

installment due dates.

1. The tax shown on line 5e of its

legislation enacted after they were

2012 Form 8804 or

If there is an underpayment on line 12

published, go to

(column (a), (b), (c), or (d)), go to Part VII

2. The total section 1446 tax that

to figure the penalty.

would have been due for 2011, without

What's New

Complete Parts IV through VI as

regard to reductions for certified foreign

appropriate if the partnership uses the

On February 22, 2012, Section 7001 of PL

partner-level items, on the ECTI allocable

adjusted seasonal installment method

112-96, the Middle Class Tax Relief and

to foreign partners for 2011, provided that

and/or the annualized income installment

Job Creation Act of 2012, repealed

(1) this amount is at least 50% of the sum

method.

section 505 of PL 112-41, and section 502

of the amounts shown on lines 4d, 4h, 4l,

of PL 112-43, which had required changes

and 4p of its 2012 Form 8804 and (2) the

Specific Instructions

to the 2011 Schedule A (Form 8804) and

tax year was for a full 12 months. See the

instructions for fiscal year partnerships

instructions for line 2 below for more

with assets of $1 billion or more. Although

details.

Part I. Reasons for Filing

the 2011 Schedule A (Form 8804) and

In these instructions,“Form

instructions were not reissued, those

8804”generally refers to the partnership's

Adjusted seasonal installment method

changes are reflected in the 2012

original Form 8804. However, an

and/or annualized income installment

Schedule A (Form 8804) and instructions.

amended Form 8804 is considered the

method. If the partnership's income

See the Recent Developments at

original Form 8804 if the amended Form

varied during the year because, for

for more

8804 is filed by the due date (including

example, it operated its business on a

information.

extensions) of the original Form 8804.

seasonal basis, it may be able to lower or

eliminate the amount of one or more

General Instructions

Also, for purposes of determining a

required installments by using the

required installment, if an amended Form

adjusted seasonal installment method

8804 is filed for the prior tax year, then

Purpose of Form

and/or the annualized income installment

“prior tax year” includes the amended

method.

Form 8804, but only if the amended Form

Partnerships that have effectively

8804 is filed before the applicable

Example. A ski shop, which receives

connected taxable income (ECTI)

installment due date.

most of its income during the winter

allocable to foreign partners use

months, may benefit from using one or

Schedule A (Form 8804) to determine:

The penalty is figured separately for

both of these methods to figure its

Whether they are subject to the penalty

each installment due date. Therefore, the

required installments. The annualized

for underpayment of estimated tax and, if

partnership may owe a penalty for an

income installment or adjusted seasonal

so,

earlier due date even if it paid enough tax

installment may be less than the required

The amount of the underpayment

later to make up the underpayment. This is

installment under the current year safe

penalty.

true even if the partnership is due a refund

harbor (increased by any reduction

when its return is filed. However, the

Who Must File

recaptured under section 6655(e)(1)(B))

partnership may be able to reduce or

for one or more due dates. Using one or

Generally, the partnership does not have

eliminate the penalty by using the

both of these methods may reduce or

to file this schedule because the IRS will

annualized income installment method or

eliminate the penalty for those due dates.

figure the amount of the penalty and notify

the adjusted seasonal installment method.

Use Parts IV through VI on pages 2

the partnership of any amount due.

See the instructions for Parts IV and V for

through 4 of Schedule A (Form 8804) to

However, even if the partnership does not

details.

figure one or more required installments. If

owe a penalty, complete and attach this

Parts IV through VI are used for any

Exception to the Penalty

schedule to the partnership's Form 8804 if

payment due date, those Parts must be

the Part II, line 1 amount on page 1 is

A partnership will not have to pay a

used for all subsequent payment due

$500 or more and any of the following

penalty if the tax shown on line 5e of its

dates. To arrive at the amount of each

apply:

2012 Form 8804 is less than $500.

required installment, Part VI uses the

1. The adjusted seasonal installment

smallest of:

How To Use Schedule A

method is used.

The adjusted seasonal installment (if

2. The annualized income installment

applicable),

Complete this schedule as follows:

method is used.

The annualized income installment (if

Check one or both of the boxes in Part I

applicable), or

that apply. If the partnership checks a box

Aug 25, 2012

Cat. No. 36325U

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4