Form 2000-4 - Settlement Or Compromise Of Tax Liability Form - Arkansas Department Of Finance And Administration

ADVERTISEMENT

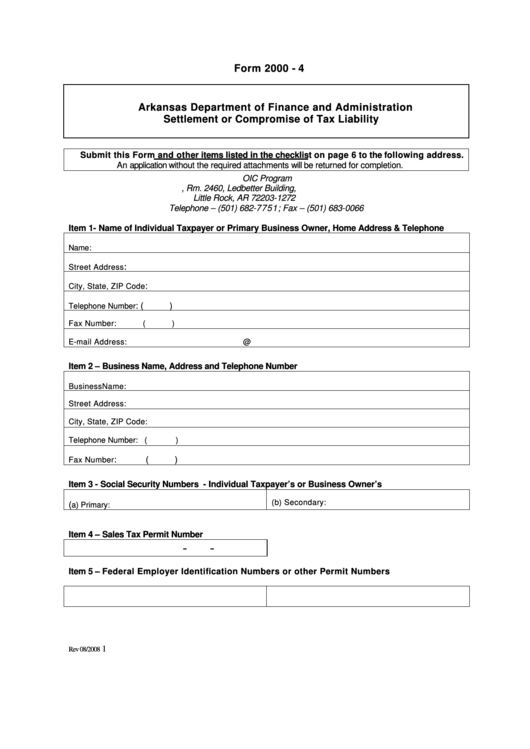

Form 2000 - 4

Arkansas Department of Finance and Administration

Settlement or Compromise of Tax Liability

Submit this Form and other items listed in the checklist on page 6 to the following address.

An application without the required attachments will be returned for completion.

OIC Program

P.O. Box 1272, Rm. 2460, Ledbetter Building,

Little Rock, AR 72203-1272

Telephone – (501) 682-7751; Fax – (501) 683-0066

Item 1- Name of Individual Taxpayer or Primary Business Owner, Home Address & Telephone

Name:

:

Street Address

:

City, State, ZIP Code

: (

)

Telephone Number

Fax Number:

(

)

E-mail Address:

@

Item 2 – Business Name, Address and Telephone Number

Business Name:

Street Address:

City, State, ZIP Code:

Telephone Number: (

)

:

(

)

Fax Number

Item 3 - Social Security Numbers - Individual Taxpayer’s or Business Owner’s

(b) Secondary:

(

a) Primary:

Item 4 – Sales Tax Permit Number

-

-

Item 5 – Federal Employer Identification Numbers or other Permit Numbers

1

Rev 08/2008

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6