Personal Income Tax Appeal Form - Decision On Petition For Rehearing - Board Of Equalization - State Of California (Expired 2006)

ADVERTISEMENT

1

2

3

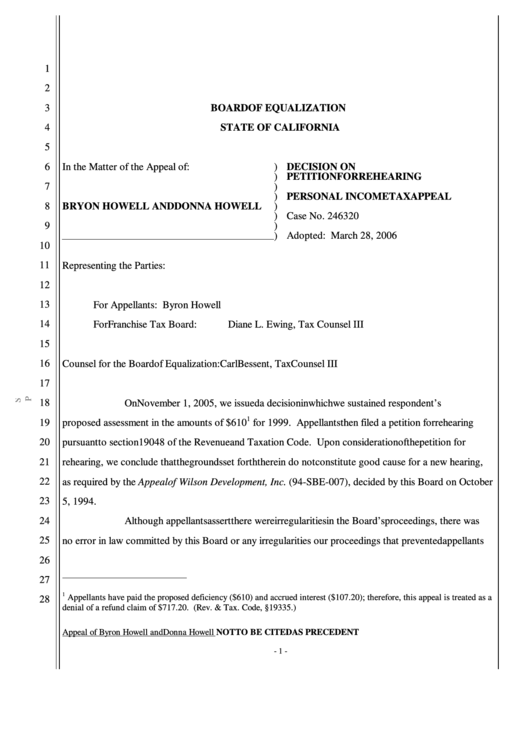

BOARD OF EQUALIZATION

4

STATE OF CALIFORNIA

5

6

In the Matter of the Appeal of:

)

DECISION ON

)

PETITION FOR REHEARING

7

)

)

PERSONAL INCOME TAX APPEAL

8

)

BRYON HOWELL AND DONNA HOWELL

)

Case No. 246320

9

)

)

Adopted: March 28, 2006

10

11

Representing the Parties:

12

13

For Appellants:

Byron Howell

14

For Franchise Tax Board:

Diane L. Ewing, Tax Counsel III

15

16

Counsel for the Board of Equalization:

Carl Bessent, Tax Counsel III

17

18

On November 1, 2005, we issued a decision in which we sustained respondent’s

1

19

proposed assessment in the amounts of $610

for 1999. Appellants then filed a petition for rehearing

20

pursuant to section 19048 of the Revenue and Taxation Code. Upon consideration of the petition for

21

rehearing, we conclude that the grounds set forth therein do not constitute good cause for a new hearing,

22

as required by the Appeal of Wilson Development, Inc. (94-SBE-007), decided by this Board on October

23

5, 1994.

24

Although appellants assert there were irregularities in the Board’s proceedings, there was

25

no error in law committed by this Board or any irregularities our proceedings that prevented appellants

26

27

1

Appellants have paid the proposed deficiency ($610) and accrued interest ($107.20); therefore, this appeal is treated as a

28

denial of a refund claim of $717.20. (Rev. & Tax. Code, § 19335.)

Appeal of Byron Howell and Donna Howell

NOT TO BE CITED AS PRECEDENT

- 1 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2