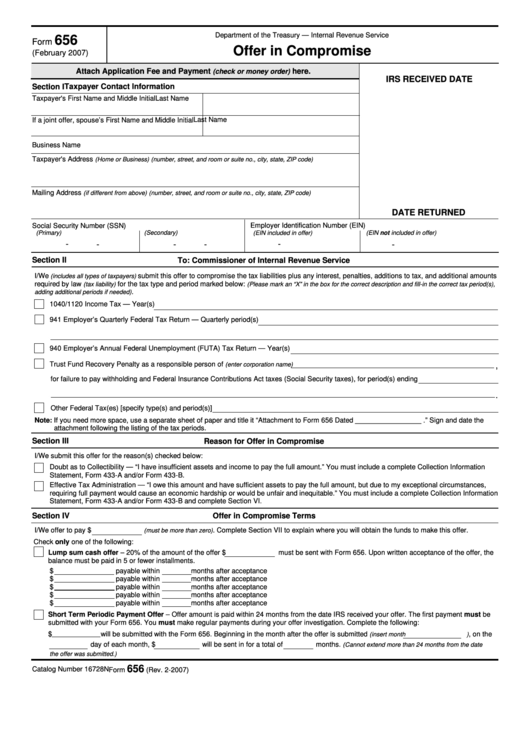

Department of the Treasury — Internal Revenue Service

656

Form

Offer in Compromise

(February 2007)

Attach Application Fee and Payment

here.

(check or money order)

IRS RECEIVED DATE

Section I

Taxpayer Contact Information

Taxpayer's First Name and Middle Initial

Last Name

Last Name

If a joint offer, spouse’s First Name and Middle Initial

Business Name

Taxpayer's Address

(Home or Business) (number, street, and room or suite no., city, state, ZIP code)

Mailing Address

(if different from above) (number, street, and room or suite no., city, state, ZIP code)

DATE RETURNED

Social Security Number (SSN)

Employer Identification Number (EIN)

(Primary)

(Secondary)

(EIN included in offer)

(EIN not included in offer)

-

-

-

-

-

-

Section II

To: Commissioner of Internal Revenue Service

I/We

submit this offer to compromise the tax liabilities plus any interest, penalties, additions to tax, and additional amounts

(includes all types of taxpayers)

required by law

for the tax type and period marked below:

(tax liability)

(Please mark an “X” in the box for the correct description and fill-in the correct tax period(s),

.

adding additional periods if needed)

1040/1120 Income Tax — Year(s)

941 Employer’s Quarterly Federal Tax Return — Quarterly period(s)

940 Employer’s Annual Federal Unemployment (FUTA) Tax Return — Year(s)

Trust Fund Recovery Penalty as a responsible person of

(enter corporation name)

,

for failure to pay withholding and Federal Insurance Contributions Act taxes (Social Security taxes), for period(s) ending

.

Other Federal Tax(es) [specify type(s) and period(s)]

Note: If you need more space, use a separate sheet of paper and title it “Attachment to Form 656 Dated _________________ .” Sign and date the

attachment following the listing of the tax periods.

Section III

Reason for Offer in Compromise

I/We submit this offer for the reason(s) checked below:

Doubt as to Collectibility — “I have insufficient assets and income to pay the full amount.” You must include a complete Collection Information

Statement, Form 433-A and/or Form 433-B.

Effective Tax Administration — “I owe this amount and have sufficient assets to pay the full amount, but due to my exceptional circumstances,

requiring full payment would cause an economic hardship or would be unfair and inequitable.” You must include a complete Collection Information

Statement, Form 433-A and/or Form 433-B and complete Section VI.

Section IV

Offer in Compromise Terms

I/We offer to pay $

. Complete Section VII to explain where you will obtain the funds to make this offer.

(must be more than zero)

Check only one of the following:

Lump sum cash offer – 20% of the amount of the offer $

must be sent with Form 656. Upon written acceptance of the offer, the

balance must be paid in 5 or fewer installments.

$

payable within

months after acceptance

$

payable within

months after acceptance

$

payable within

months after acceptance

$

payable within

months after acceptance

$

payable within

months after acceptance

Short Term Periodic Payment Offer – Offer amount is paid within 24 months from the date IRS received your offer. The first payment must be

submitted with your Form 656. You must make regular payments during your offer investigation. Complete the following:

$

will be submitted with the Form 656. Beginning in the month after the offer is submitted

, on the

(insert month

)

day of each month, $

will be sent in for a total of

months.

(Cannot extend more than 24 months from the date

the offer was submitted.)

656

Catalog Number 16728N

Form

(Rev. 2-2007)

1

1 2

2 3

3 4

4