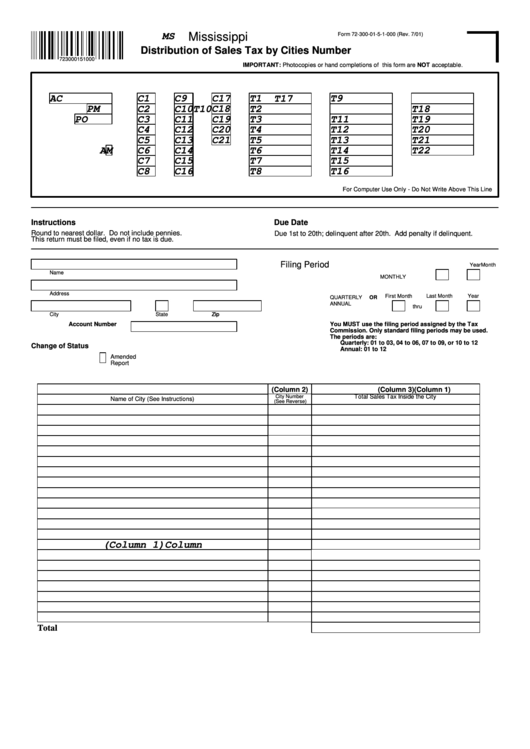

Form 72-300-01-5-1-000 - Distribution Of Sales Tax By Cities Number - Mississippi

ADVERTISEMENT

Mississippi

Form 72-300-01-5-1-000 (Rev. 7/01)

MS

Distribution of Sales Tax by Cities Number

723000151000

IMPORTANT: Photocopies or hand completions of this form are NOT acceptable.

AC

C1

C9

C17

T1

T9

T17

PM

C2

C10

C18

T2

T10

T18

PO

C3

C11

C19

T3

T11

T19

C4

C12

C20

T4

T12

T20

C5

C13

C21

T5

T13

T21

AM

C6

C14

T6

T14

T22

C7

C15

T7

T15

C8

C16

T8

T16

For Computer Use Only - Do Not Write Above This Line

Instructions

Due Date

Round to nearest dollar. Do not include pennies.

Due 1st to 20th; delinquent after 20th. Add penalty if delinquent.

This return must be filed, even if no tax is due.

Filing Period

Month

Year

Name

MONTHLY

Address

First Month

Last Month

Year

QUARTERLY

OR

ANNUAL

thru

City

State

Zip

Zip

Account Number

You MUST use the filing period assigned by the Tax

Commission. Only standard filing periods may be used.

The periods are:

Quarterly: 01 to 03, 04 to 06, 07 to 09, or 10 to 12

Change of Status

Annual: 01 to 12

Amended

Report

(Column 1)

(Column 2)

(Column 3)

City Number

Total Sales Tax Inside the City

Name of City (See Instructions)

(See Reverse)

(Column 1)Column

Total.............................................................................................

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1