MONTANA

Clear Form

VT

Rev 02 16

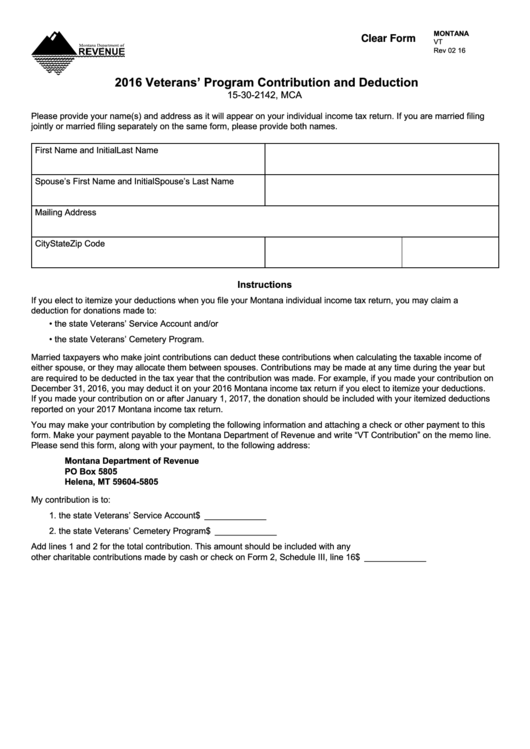

2016 Veterans’ Program Contribution and Deduction

15-30-2142, MCA

Please provide your name(s) and address as it will appear on your individual income tax return. If you are married filing

jointly or married filing separately on the same form, please provide both names.

First Name and Initial

Last Name

Spouse’s First Name and Initial

Spouse’s Last Name

Mailing Address

City

State

Zip Code

Instructions

If you elect to itemize your deductions when you file your Montana individual income tax return, you may claim a

deduction for donations made to:

•

the state Veterans’ Service Account and/or

•

the state Veterans’ Cemetery Program.

Married taxpayers who make joint contributions can deduct these contributions when calculating the taxable income of

either spouse, or they may allocate them between spouses. Contributions may be made at any time during the year but

are required to be deducted in the tax year that the contribution was made. For example, if you made your contribution on

December 31, 2016, you may deduct it on your 2016 Montana income tax return if you elect to itemize your deductions.

If you made your contribution on or after January 1, 2017, the donation should be included with your itemized deductions

reported on your 2017 Montana income tax return.

You may make your contribution by completing the following information and attaching a check or other payment to this

form. Make your payment payable to the Montana Department of Revenue and write “VT Contribution” on the memo line.

Please send this form, along with your payment, to the following address:

Montana Department of Revenue

PO Box 5805

Helena, MT 59604-5805

My contribution is to:

1. the state Veterans’ Service Account .....................................................................$ _____________

2. the state Veterans’ Cemetery Program ................................................................$ _____________

Add lines 1 and 2 for the total contribution. This amount should be included with any

other charitable contributions made by cash or check on Form 2, Schedule III, line 16 .... $ _____________

1

1