Form App-103 - Application For A Sales Tax Refund On The Purchase Of Depreciable Machinery - Maine Revenue Services

ADVERTISEMENT

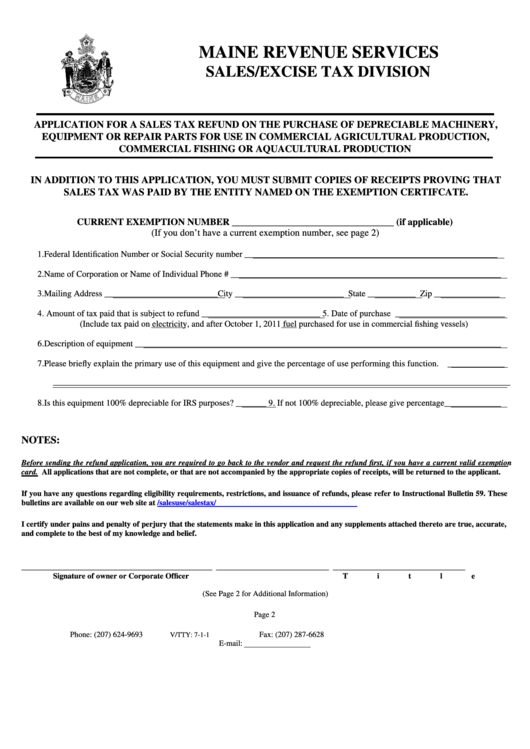

MAINE REVENUE SERVICES

SALES/EXCISE TAX DIVISION

APPLICATION FOR A SALES TAX REFUND ON THE PURCHASE OF DEPRECIABLE MACHINERY,

EQUIPMENT OR REPAIR PARTS FOR USE IN COMMERCIAL AGRICULTURAL PRODUCTION,

COMMERCIAL FISHING OR AQUACULTURAL PRODUCTION

IN ADDITION TO THIS APPLICATION, YOU MUST SUBMIT COPIES OF RECEIPTS PROVING THAT

SALES TAX WAS PAID BY THE ENTITY NAMED ON THE EXEMPTION CERTIFCATE.

CURRENT EXEMPTION NUMBER __________________________________ (if applicable)

(If you don’t have a current exemption number, see page 2)

1. Federal Identification Number or Social Security number __________________________________________________________

2. Name of Corporation or Name of Individual Phone # ______________________________________________________________

3. Mailing Address __________________________City _________________________ State ___________ Zip _______________

4.

Amount of tax paid that is subject to refund ___________________________ 5. Date of purchase _________________________

(Include tax paid on electricity, and after October 1, 2011 fuel purchased for use in commercial fishing vessels)

6. Description of equipment ____________________________________________________________________________________

7. Please briefly explain the primary use of this equipment and give the percentage of use performing this function. _____________

_________________________________________________________________________________________________________

8. Is this equipment 100% depreciable for IRS purposes? _______ 9. If not 100% depreciable, please give percentage_____________

NOTES:

Before sending the refund application, you are required to go back to the vendor and request the refund first, if you have a current valid exemption

card. All applications that are not complete, or that are not accompanied by the appropriate copies of receipts, will be returned to the applicant.

If you have any questions regarding eligibility requirements, restrictions, and issuance of refunds, please refer to Instructional Bulletin 59. These

bulletins are available on our web site at

I certify under pains and penalty of perjury that the statements make in this application and any supplements attached thereto are true, accurate,

and complete to the best of my knowledge and belief.

_________________________________________________

_____________________________

__________________________________

Signature of owner or Corporate Officer

Title

Date Signed

(See Page 2 for Additional Information)

Page 2

Phone: (207) 624-9693

Fax: (207) 287-6628

V/TTY: 7-1-1

E-mail: sales.tax@maine.gov

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2