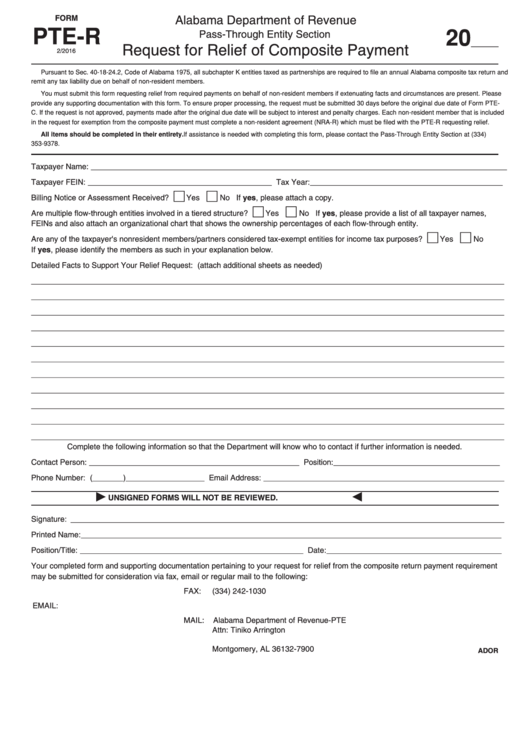

FORM

Alabama Department of Revenue

PTE R

20

Pass-Through Entity Section

_______

Request for Relief of Composite Payment

2/2016

Pursuant to Sec. 40-18-24.2, Code of Alabama 1975, all subchapter K entities taxed as partnerships are required to file an annual Alabama composite tax return and

remit any tax liability due on behalf of non-resident members.

You must submit this form requesting relief from required payments on behalf of non-resident members if extenuating facts and circumstances are present. Please

provide any supporting documentation with this form. To ensure proper processing, the request must be submitted 30 days before the original due date of Form PTE-

C. If the request is not approved, payments made after the original due date will be subject to interest and penalty charges. Each non-resident member that is included

in the request for exemption from the composite payment must complete a non-resident agreement (NRA-R) which must be filed with the PTE-R requesting relief.

All items should be completed in their entirety. If assistance is needed with completing this form, please contact the Pass-Through Entity Section at (334)

353-9378.

Taxpayer Name: _______________________________________________________________________________________________

Taxpayer FEIN: __________________________________________ Tax Year: ____________________________________________

Billing Notice or Assessment Received?

Yes

No

If yes, please attach a copy.

Are multiple flow-through entities involved in a tiered structure?

Yes

No

If yes, please provide a list of all taxpayer names,

FEINs and also attach an organizational chart that shows the ownership percentages of each flow-through entity.

Are any of the taxpayer's nonresident members/partners considered tax-exempt entities for income tax purposes?

Yes

No

If yes, please identify the members as such in your explanation below.

Detailed Facts to Support Your Relief Request: (attach additional sheets as needed)

____________________________________________________________________________________________________________

____________________________________________________________________________________________________________

____________________________________________________________________________________________________________

____________________________________________________________________________________________________________

____________________________________________________________________________________________________________

____________________________________________________________________________________________________________

____________________________________________________________________________________________________________

____________________________________________________________________________________________________________

____________________________________________________________________________________________________________

____________________________________________________________________________________________________________

____________________________________________________________________________________________________________

Complete the following information so that the Department will know who to contact if further information is needed.

Contact Person: ________________________________________________ Position: ______________________________________

Phone Number: (_______)__________________ Email Address: _______________________________________________________

UNSIGNED FORMS WILL NOT BE REVIEWED.

Signature: ___________________________________________________________________________________________________

Printed Name: ________________________________________________________________________________________________

Position/Title: ___________________________________________________ Date: ________________________________________

Your completed form and supporting documentation pertaining to your request for relief from the composite return payment requirement

may be submitted for consideration via fax, email or regular mail to the following:

FAX:

(334) 242-1030

EMAIL: Tiniko.Arrington@revenue.alabama.gov

MAIL:

Alabama Department of Revenue-PTE

Attn: Tiniko Arrington

P.O. Box 327900

Montgomery, AL 36132-7900

ADOR

1

1 2

2 3

3