Form Dr 1480 - County Short-Term Rental Tax Return Form - Colorado Department Of Revenue, Clorado

ADVERTISEMENT

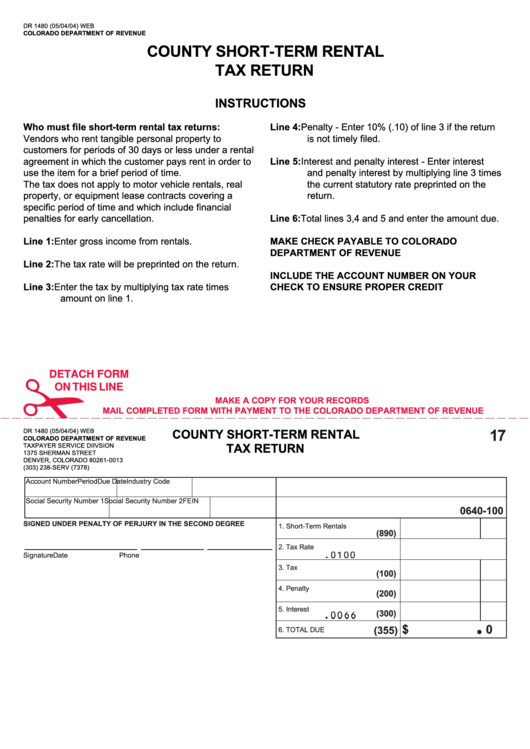

DR 1480 (05/04/04) WEB

COLORADO DEPARTMENT OF REVENUE

COUNTY SHORT-TERM RENTAL

TAX RETURN

INSTRUCTIONS

Who must file short-term rental tax returns:

Line 4: Penalty - Enter 10% (.10) of line 3 if the return

Vendors who rent tangible personal property to

is not timely filed.

customers for periods of 30 days or less under a rental

agreement in which the customer pays rent in order to

Line 5: Interest and penalty interest - Enter interest

use the item for a brief period of time.

and penalty interest by multiplying line 3 times

The tax does not apply to motor vehicle rentals, real

the current statutory rate preprinted on the

property, or equipment lease contracts covering a

return.

specific period of time and which include financial

penalties for early cancellation.

Line 6: Total lines 3,4 and 5 and enter the amount due.

Line 1: Enter gross income from rentals.

MAKE CHECK PAYABLE TO COLORADO

DEPARTMENT OF REVENUE

Line 2: The tax rate will be preprinted on the return.

INCLUDE THE ACCOUNT NUMBER ON YOUR

Line 3: Enter the tax by multiplying tax rate times

CHECK TO ENSURE PROPER CREDIT

amount on line 1.

DETACH FORM

ON THIS LINE

MAKE A COPY FOR YOUR RECORDS

MAIL COMPLETED FORM WITH PAYMENT TO THE COLORADO DEPARTMENT OF REVENUE

DR 1480 (05/04/04) WEB

COUNTY SHORT-TERM RENTAL

17

COLORADO DEPARTMENT OF REVENUE

TAXPAYER SERVICE DIIVSION

TAX RETURN

1375 SHERMAN STREET

DENVER, COLORADO 80261-0013

(303) 238-SERV (7378)

Account Number

Period

Due Date

Industry Code

Social Security Number 1

Social Security Number 2

FEIN

0640-100

SIGNED UNDER PENALTY OF PERJURY IN THE SECOND DEGREE

1. Short-Term Rentals

(890)

2. Tax Rate

Signature

Date

Phone

3. Tax

(100)

4. Penalty

(200)

5. Interest

(300)

$

00

(355)

•

6. TOTAL DUE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1