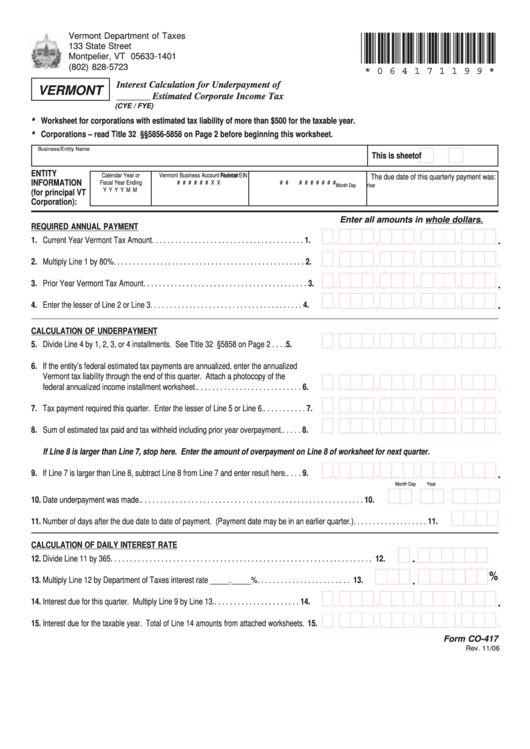

Form Co-417 - Interest Calculation For Underpayment Of Estimated Corporate Income Tax

ADVERTISEMENT

Vermont Department of Taxes

*064171199*

133 State Street

Montpelier, VT 05633-1401

(802) 828-5723

* 0 6 4 1 7 1 1 9 9 *

Interest Calculation for Underpayment of

VERMONT

_______ Estimated Corporate Income Tax

(CYE / FYE)

•

Worksheet for corporations with estimated tax liability of more than $500 for the taxable year.

•

Corporations – read Title 32 V.S.A. §§5856-5858 on Page 2 before beginning this worksheet.

Business/Entity Name

This is sheet

of

ENTITY

Calendar Year or

Vermont Business Account Number

Federal EIN

The due date of this quarterly payment was:

INFORMATION

Fiscal Year Ending

# # # # # # X X

# #

# # # # # # #

Month

Day

Year

Y Y Y Y M M

(for principal VT

Corporation):

Enter all amounts in whole dollars.

REQUIRED ANNUAL PAYMENT

,

,

,

,

.

1. Current Year Vermont Tax Amount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.

,

,

,

,

.

2. Multiply Line 1 by 80% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.

,

,

,

,

.

3. Prior Year Vermont Tax Amount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.

,

,

,

,

.

4. Enter the lesser of Line 2 or Line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.

CALCULATION OF UNDERPAYMENT

,

,

,

,

.

5. Divide Line 4 by 1, 2, 3, or 4 installments. See Title 32 V.S.A. §5858 on Page 2 . . . . 5.

6. If the entity’s federal estimated tax payments are annualized, enter the annualized

Vermont tax liability through the end of this quarter. Attach a photocopy of the

,

,

,

,

.

federal annualized income installment worksheet. . . . . . . . . . . . . . . . . . . . . . . . . . . . 6.

,

,

,

,

.

7. Tax payment required this quarter. Enter the lesser of Line 5 or Line 6. . . . . . . . . . . . 7.

,

,

,

,

.

8. Sum of estimated tax paid and tax withheld including prior year overpayment. . . . . . 8.

If Line 8 is larger than Line 7, stop here. Enter the amount of overpayment on Line 8 of worksheet for next quarter.

,

,

,

,

.

9. If Line 7 is larger than Line 8, subtract Line 8 from Line 7 and enter result here. . . . . 9.

Month

Day

Year

10. Date underpayment was made. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10.

11. Number of days after the due date to date of payment. (Payment date may be in an earlier quarter.) . . . . . . . . . . . . . . . . . . . 11.

CALCULATION OF DAILY INTEREST RATE

.

12. Divide Line 11 by 365 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12.

%

.

13. Multiply Line 12 by Department of Taxes interest rate _____._____% . . . . . . . . . . . . . . . . . . . . . . . . 13.

,

,

,

,

.

14. Interest due for this quarter. Multiply Line 9 by Line 13. . . . . . . . . . . . . . . . . . . . . . . 14.

,

,

,

,

.

15. Interest due for the taxable year. Total of Line 14 amounts from attached worksheets. 15.

Form CO-417

Rev. 11/06

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1