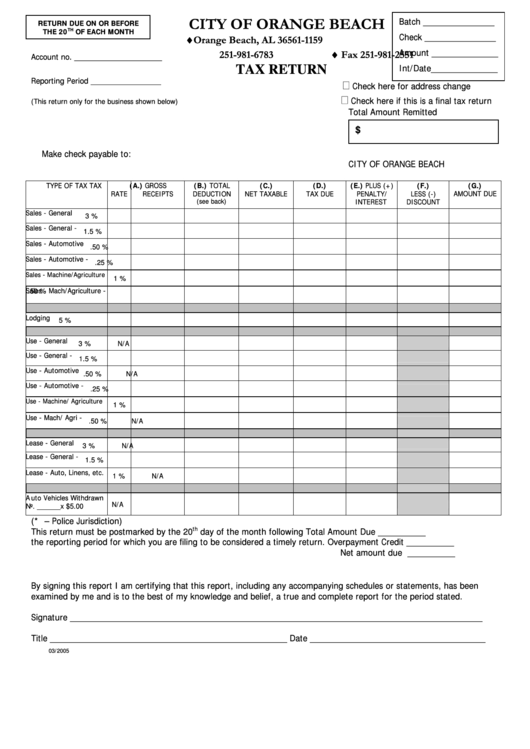

Tax Return Form - City Of Orange Beach - 2005

ADVERTISEMENT

CITY OF ORANGE BEACH

Batch _______________

RETURN DUE ON OR BEFORE

TH

THE 20

OF EACH MONTH

Check _______________

P.O. Box 1159 ♦Orange Beach, AL 36561-1159

Amount ______________

251-981-6783 ♦ Fax 251-981-2551

Account no. ____________________

Int/Date______________

TAX RETURN

Reporting Period ________________

Check here for address change

Check here if this is a final tax return

(This return only for the business shown below)

Total Amount Remitted

$

Make check payable to:

CITY OF ORANGE BEACH

TYPE OF TAX

TAX

(A.) GROSS

(B.) TOTAL

(C.)

(D.)

(E.) PLUS (+)

(F.)

(G.)

RATE

RECEIPTS

DEDUCTION

NET TAXABLE

TAX DUE

PENALTY/

LESS (-)

AMOUNT DUE

(see back)

INTEREST

DISCOUNT

Sales - General

3 %

Sales - General - P.J.

1.5 %

Sales - Automotive

.50 %

Sales - Automotive - P.J.

.25 %

Sales - Machine/Agriculture

1 %

Sales - Mach/Agriculture -

.50 %

P.J.

Lodging

5 %

Use - General

3 %

N/A

Use - General - P.J.

1.5 %

Use - Automotive

.50 %

N/A

Use - Automotive - P.J.

.25 %

Use - Machine/ Agriculture

1 %

Use - Mach/ Agri - P.J.

.50 %

N/A

Lease - General

3 %

N/A

Lease - General - P.J.

1.5 %

Lease - Auto, Linens, etc.

1 %

N/A

Auto Vehicles Withdrawn

N/A

No. ______x $5.00

(* P.J. – Police Jurisdiction)

th

This return must be postmarked by the 20

day of the month following

Total Amount Due

__________

the reporting period for which you are filing to be considered a timely return.

Overpayment Credit

__________

Net amount due

__________

By signing this report I am certifying that this report, including any accompanying schedules or statements, has been

examined by me and is to the best of my knowledge and belief, a true and complete report for the period stated.

Signature _______________________________________________________________________________________

Title __________________________________________________ Date _____________________________________

03/2005

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2