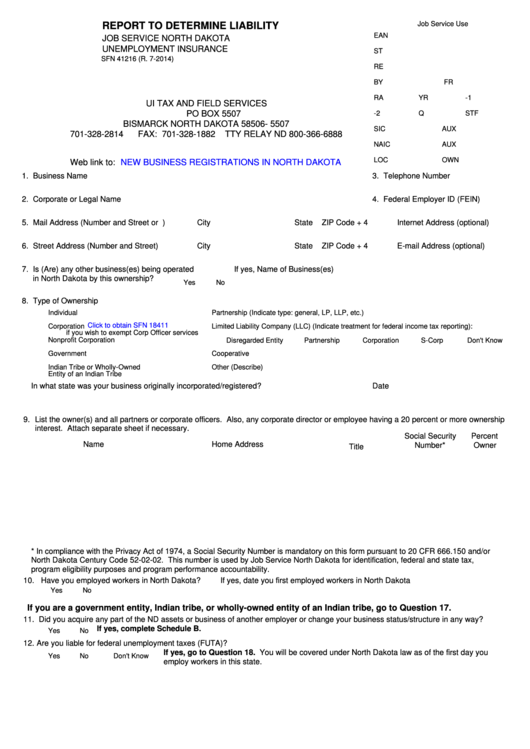

Job Service Use

REPORT TO DETERMINE LIABILITY

EAN

JOB SERVICE NORTH DAKOTA

UNEMPLOYMENT INSURANCE

ST

SFN 41216 (R. 7-2014)

RE

BY

FR

RA

YR

-1

UI TAX AND FIELD SERVICES

PO BOX 5507

-2

Q

STF

BISMARCK NORTH DAKOTA 58506- 5507

SIC

AUX

701-328-2814

FAX: 701-328-1882

TTY RELAY ND 800-366-6888

NAIC

AUX

LOC

OWN

Web link to:

NEW BUSINESS REGISTRATIONS IN NORTH DAKOTA

1. Business Name

3. Telephone Number

2. Corporate or Legal Name

4. Federal Employer ID (FEIN)

5. Mail Address (Number and Street or P.O. Box) City

State

ZIP Code + 4

Internet Address (optional)

6. Street Address (Number and Street)

City

State

ZIP Code + 4

E-mail Address (optional)

7. Is (Are) any other business(es) being operated

If yes, Name of Business(es)

in North Dakota by this ownership?

Yes

No

8. Type of Ownership

Individual

Partnership (Indicate type: general, LP, LLP, etc.)

Click to obtain SFN 18411

Corporation

Limited Liability Company (LLC) (Indicate treatment for federal income tax reporting):

if you wish to exempt Corp Officer services

Nonprofit Corporation

Disregarded Entity

Partnership

Corporation

S-Corp

Don't Know

Government

Cooperative

Indian Tribe or Wholly-Owned

Other (Describe)

Entity of an Indian Tribe

In what state was your business originally incorporated/registered?

Date

9.

List the owner(s) and all partners or corporate officers. Also, any corporate director or employee having a 20 percent or more ownership

interest. Attach separate sheet if necessary.

Social Security

Percent

Name

Home Address

Number*

Owner

Title

* In compliance with the Privacy Act of 1974, a Social Security Number is mandatory on this form pursuant to 20 CFR 666.150 and/or

North Dakota Century Code 52-02-02. This number is used by Job Service North Dakota for identification, federal and state tax,

program eligibility purposes and program performance accountability.

10. Have you employed workers in North Dakota?

If yes, date you first employed workers in North Dakota

Yes

No

If you are a government entity, Indian tribe, or wholly-owned entity of an Indian tribe, go to Question 17.

11. Did you acquire any part of the ND assets or business of another employer or change your business status/structure in any way?

If yes, complete Schedule B.

Yes

No

12. Are you liable for federal unemployment taxes (FUTA)?

If yes, go to Question 18. You will be covered under North Dakota law as of the first day you

Yes

No

Don't Know

employ workers in this state.

1

1 2

2 3

3 4

4