Form Pt 2001 - Parking Tax - City Of Pittsburgh

ADVERTISEMENT

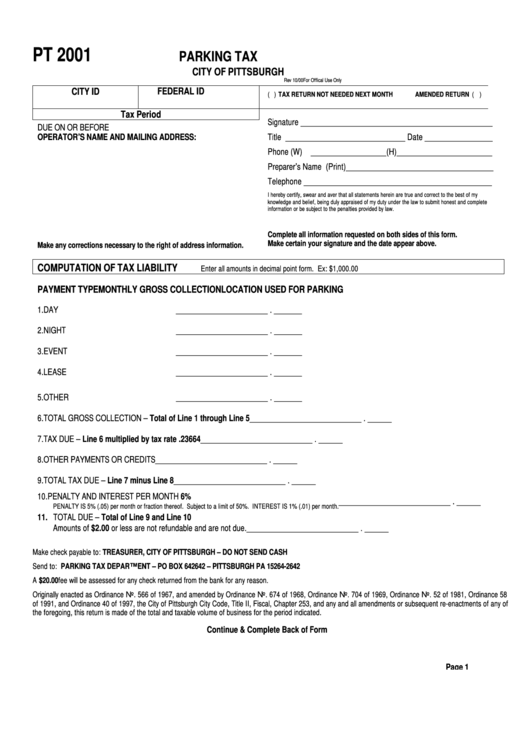

PT 2001

PARKING TAX

CITY OF PITTSBURGH

Rev 10/00

For Offical Use Only

CITY ID

FEDERAL ID

( ) TAX RETURN NOT NEEDED NEXT MONTH

AMENDED RETURN ( )

Tax Period

Signature ________________________________________________

DUE ON OR BEFORE

OPERATOR’ S NAME AND MAILING ADDRESS:

Title ______________________________ Date _________________

Phone (W) ___________________(H)________________________

Preparer’ s Name (Print)_____________________________________

Telephone _______________________________________________

I hereby certify, swear and aver that all statements herein are true and correct to the best of my

knowledge and belief, being duly appraised of my duty under the law to submit honest and complete

information or be subject to the penalties provided by law.

Complete all information requested on both sides of this form.

Make certain your signature and the date appear above.

Make any corrections necessary to the right of address information.

COMPUTATION OF TAX LIABILITY

Enter all amounts in decimal point form. Ex: $1,000.00

PAYMENT TYPE

MONTHLY GROSS COLLECTION

LOCATION USED FOR PARKING

1.

DAY

_______________________ . _______

2.

NIGHT

_______________________ . _______

3.

EVENT

_______________________ . _______

4.

LEASE

_______________________ . _______

5.

OTHER

_______________________ . _______

6.

TOTAL GROSS COLLECTION – Total of Line 1 through Line 5

____________________________ . ______

7.

TAX DUE – Line 6 multiplied by tax rate .23664

____________________________ . ______

8.

OTHER PAYMENTS OR CREDITS

____________________________ . ______

9.

TOTAL TAX DUE – Line 7 minus Line 8

____________________________ . ______

10. PENALTY AND INTEREST PER MONTH 6%

____________________________ . ______

PENALTY IS 5% (.05) per month or fraction thereof. Subject to a limit of 50%. INTEREST IS 1% (.01) per month.

11. TOTAL DUE – Total of Line 9 and Line 10

Amounts of $2.00 or less are not refundable and are not due.

____________________________ . ______

Make check payable to: TREASURER, CITY OF PITTSBURGH – DO NOT SEND CASH

Send to: PARKING TAX DEPARTMENT – PO BOX 642642 – PITTSBURGH PA 15264-2642

A $20.00 fee will be assessed for any check returned from the bank for any reason.

Originally enacted as Ordinance No. 566 of 1967, and amended by Ordinance No. 674 of 1968, Ordinance No. 704 of 1969, Ordinance No. 52 of 1981, Ordinance 58

of 1991, and Ordinance 40 of 1997, the City of Pittsburgh City Code, Title II, Fiscal, Chapter 253, and any and all amendments or subsequent re-enactments of any of

the foregoing, this return is made of the total and taxable volume of business for the period indicated.

Continue & Complete Back of Form

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2