Form Wv/brt-Fr - Foreign Retailer Voluntarily Collecting And Remitting Use Tax On Sales To West Virginia Customers

ADVERTISEMENT

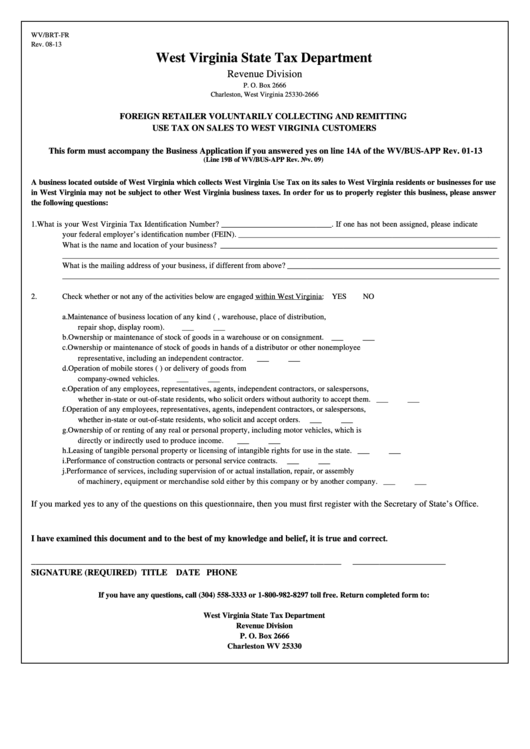

WV/BRT-FR

Rev. 08-13

West Virginia State Tax Department

Revenue Division

P. O. Box 2666

Charleston, West Virginia 25330-2666

FOREIGN RETAILER VOLUNTARILY COLLECTING AND REMITTING

USE TAX ON SALES TO WEST VIRGINIA CUSTOMERS

This form must accompany the Business Application if you answered yes on line 14A of the WV/BUS-APP Rev. 01-13

(Line 19B of WV/BUS-APP Rev. Nov. 09)

A business located outside of West Virginia which collects West Virginia Use Tax on its sales to West Virginia residents or businesses for use

in West Virginia may not be subject to other West Virginia business taxes. In order for us to properly register this business, please answer

the following questions:

1.

What is your West Virginia Tax Identification Number? ____________________________. If one has not been assigned, please indicate

your federal employer’s identification number (FEIN). ___________________________________________________________________

What is the name and location of your business? _______________________________________________________________________

________________________________________________________________________________________________________________

What is the mailing address of your business, if different from above? ______________________________________________________

________________________________________________________________________________________________________________

2.

Check whether or not any of the activities below are engaged within West Virginia:

YES

NO

a.

Maintenance of business location of any kind (i.e. office, warehouse, place of distribution,

repair shop, display room).

___

___

b.

Ownership or maintenance of stock of goods in a warehouse or on consignment.

___

___

c.

Ownership or maintenance of stock of goods in hands of a distributor or other nonemployee

representative, including an independent contractor.

___

___

d.

Operation of mobile stores (i.e. trucks with driver/salesman) or delivery of goods from

company-owned vehicles.

___

___

e.

Operation of any employees, representatives, agents, independent contractors, or salespersons,

whether in-state or out-of-state residents, who solicit orders without authority to accept them.

___

___

f.

Operation of any employees, representatives, agents, independent contractors, or salespersons,

whether in-state or out-of-state residents, who solicit and accept orders.

___

___

g.

Ownership of or renting of any real or personal property, including motor vehicles, which is

directly or indirectly used to produce income.

___

___

h.

Leasing of tangible personal property or licensing of intangible rights for use in the state.

___

___

i.

Performance of construction contracts or personal service contracts.

___

___

j.

Performance of services, including supervision of or actual installation, repair, or assembly

of machinery, equipment or merchandise sold either by this company or by another company.

___

___

If you marked yes to any of the questions on this questionnaire, then you must first register with the Secretary of State’s Office.

I have examined this document and to the best of my knowledge and belief, it is true and correct

.

_____________________________

______________________

___________________

_____________________

SIGNATURE (REQUIRED)

TITLE

DATE

PHONE

If you have any questions, call (304) 558-3333 or 1-800-982-8297 toll free. Return completed form to:

West Virginia State Tax Department

Revenue Division

P. O. Box 2666

Charleston WV 25330

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1