*144342100*

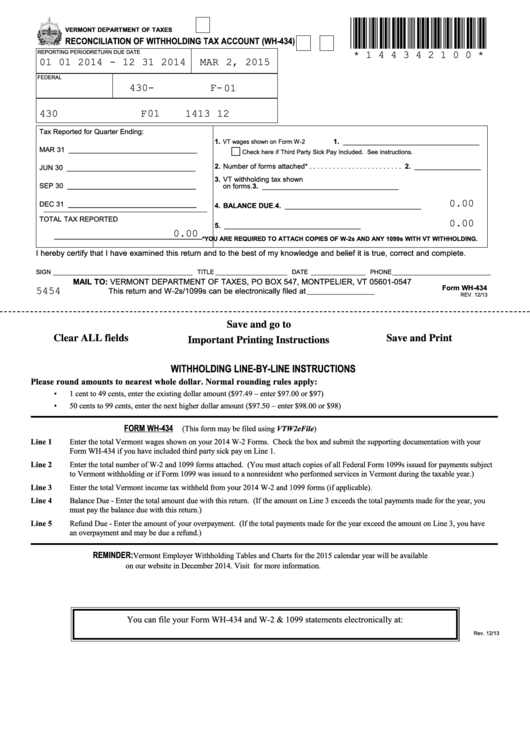

VERMONT DEPARTMENT OF TAXES

RECONCILIATION OF WITHHOLDING TAX ACCOUNT (WH-434)

* 1 4 4 3 4 2 1 0 0 *

REPORTING PERIOD

RETURN DUE DATE

01 01 2014 - 12 31 2014

MAR 2, 2015

FEDERAL I.D. NO.

VT. ACCOUNT NO.

123456789

430-123456789F-01

01

430

123 456 789 F01 OW

1413 12

01

Tax Reported for Quarter Ending:

1.

1. ___________________________________

VT wages shown on Form W-2 . . . . . . . .

MAR 31

_________________________________

c

Check here if Third Party Sick Pay Included. See instructions.

2. Number of forms attached* . . . . . . . . . . . . . . . . . . . . . . . . 2. _________________

JUN 30

_________________________________

3. VT withholding tax shown

SEP 30

_________________________________

on forms. . . . . . . . . . . . . . . . . . . . . . 3. ___________________________________

0.00

DEC 31

_________________________________

4. BALANCE DUE. . . . . . . . . . . . . . . . 4. ___________________________________

TOTAL TAX REPORTED

0.00

5. REFUND DUE . . . . . . . . . . . . . . . . 5. ___________________________________

0.00

______________________________________

*YOU ARE REQUIRED TO ATTACH COPIES OF W-2s AND ANY 1099s WITH VT WITHHOLDING.

I hereby certify that I have examined this return and to the best of my knowledge and belief it is true, correct and complete.

SIGN _________________________________________ TITLE _____________________ DATE ________________ PHONE _____________________________

MAIL TO: VERMONT DEPARTMENT OF TAXES, PO BOX 547, MONTPELIER, VT 05601-0547

5454

Form WH-434

This return and W-2s/1099s can be electronically filed at

REV. 12/13

Save and go to

Clear ALL fields

Save and Print

Important Printing Instructions

WITHHOLDING LINE-BY-LINE INSTRUCTIONS

Please round amounts to nearest whole dollar. Normal rounding rules apply:

•

1 cent to 49 cents, enter the existing dollar amount ($97.49 – enter $97.00 or $97)

•

50 cents to 99 cents, enter the next higher dollar amount ($97.50 – enter $98.00 or $98)

FORM WH-434

(This form may be filed using VTW2eFile)

Line 1

Enter the total Vermont wages shown on your 2014 W-2 Forms. Check the box and submit the supporting documentation with your

Form WH-434 if you have included third party sick pay on Line 1.

Line 2

Enter the total number of W-2 and 1099 forms attached. (You must attach copies of all Federal Form 1099s issued for payments subject

to Vermont withholding or if Form 1099 was issued to a nonresident who performed services in Vermont during the taxable year.)

Line 3

Enter the total Vermont income tax withheld from your 2014 W-2 and 1099 forms (if applicable).

Line 4

Balance Due - Enter the total amount due with this return. (If the amount on Line 3 exceeds the total payments made for the year, you

must pay the balance due with this return.)

Line 5

Refund Due - Enter the amount of your overpayment. (If the total payments made for the year exceed the amount on Line 3, you have

an overpayment and may be due a refund.)

REMINDER:

Vermont Employer Withholding Tables and Charts for the 2015 calendar year will be available

on our website in December 2014. Visit for more information.

You can file your Form WH-434 and W-2 & 1099 statements electronically at:

Rev. 12/13

1

1