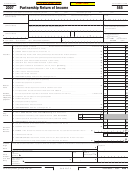

18 Depletion . Do not deduct oil and gas depletion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

00

00

19 Retirement plans, etc . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

00

20 Employee benefit programs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

00

21 Other deductions . Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

00

22 Total deductions . Add line 13 through line 21 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

00

23 Ordinary income (loss) from trade or business activities . Subtract line 22 from line 12 . . . . . . . . . . . . . . . . . .

23

24 Tax — $800.00 (LPs, LLPs, and REMICs only). See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24

00

25 Withholding (Form 592-B and/or 593) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25

00

26 Amount paid with extension of time to file return (form FTB 3538) . . . . . . . . .

26

00

27 Total payments . Add line 25 and line 26 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

27

00

00

28 Use Tax. This is not a total line. See instructions . . . . . . . . . . . . . . . . . . . . . .

28

00

29 Payments balance . If line 27 is more than line 28, subtract line 28 from line 27 . . . . . . . . . . . . . . . . . . . . . . . .

29

00

30 Use Tax balance. If line 28 is more than line 27, subtract line 27 from line 28 . . . . . . . . . . . . . . . . . . . . . . . . .

30

00

31 Tax due . If line 24 is more than line 29, subtract line 29 from line 24 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

31

.

00

,

,

32 Refund . If line 29 is more than line 24, subtract line 24 from line 29 . . . . . . . . . . . . . . . . . . . . .

32

00

33 Penalties and interest . See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

33

34 Total amount due . Add line 30, line 31, and line 33 .

.

,

,

00

Make the check or money order payable to the Franchise Tax Board . . . . . . . . . . . . . . . . . . . . .

34

Schedule A Cost of Goods Sold

00

1 Inventory at beginning of year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

00

2 Purchases less cost of items withdrawn for personal use . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

00

3 Cost of labor . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

00

4 Additional IRC Section 263A costs . Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

00

5 Other costs . Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

00

6 Total . Add line 1 through line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7 Inventory at end of year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

00

00

8 Cost of goods sold . Subtract line 7 from line 6 . Enter here and on Side 1, line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

9 a Check all methods used for valuing closing inventory:

Lower of cost or market as described in Treas . Reg . Section 1 .471-4

Write down of “subnormal” goods as

(1)

Cost

(2)

(3)

described in Treas . Reg . Section 1 .471-2(c)

(4)

Other . Specify method used and attach explanation ___________________________

b Check this box if the LIFO inventory method was adopted this taxable year for any goods . If checked, attach federal Form 970 . . . . . . . .

c Do the rules of IRC Section 263A (with respect to property produced or acquired for resale) apply to the partnership? . . . . . . . . . . . . . .

Yes

No

d Was there any change (other than for IRC Section 263A purposes) in determining quantities, cost, or valuations between opening

and closing inventory? If “Yes,” attach explanation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

K What type of entity is filing this return? Check one only:

1

General partnership

2

LP required to pay annual tax (is doing business in CA, is registered with SOS, or is organized in CA)

3

LP, LLC, or other entity NOT required to pay annual tax (is not doing business in CA, is not registered with SOS, and is not organized in CA)

4

5

6

REMIC

LLP

Other (See instructions)

L Enter the maximum number of partners in this partnership at any time during the year . Attach a CA Sch . K-1 (565)

for each partner . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

M Is any partner of the partnership related (as defined in IRC Section 267(c)(4)) to any other partner? . . . . . . . . . . . . . . . . . . . . . . .

N Is any partner of the partnership a trust for the benefit of any person related (as defined in IRC Section 267(c)(4))

Yes

No

to any other partner? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

O Are any partners in this partnership also partnerships or LLCs? If “Yes,” complete Schedule K-1, Table 3 for each . . . . . . . . . . . . .

Yes

No

P Does the partnership meet all the requirements shown in the instructions for Question P? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

Yes

No

Q Is this partnership a partner in another partnership or multiple member LLC? If “Yes,” complete Schedule EO, Part I . . . . . . . . . . .

Side 2 Form 565

2016

3662163

C1

1

1 2

2 3

3 4

4 5

5